How to choose the right VC fund for your crypto project

The role of VC funds in the crypto market

The rapid maturity of the crypto industry that has taken place between 2020 and 2022 has attracted the attention of both traditional and retail investors and especially VC funds. The advantage of venture capital funds is raising money quickly by uniting the resources of a pool of investors.

Before investing money, venture fund managers thoroughly review projects, their documentation, and technical peculiarities to determine only viable proposals for investors. In most cases, startups turn to venture funds when they are not ready to go public. Unlike angel investors, venture funds pay attention to the soundness of projects. During the analysis of a startup, venture funds review its profit&loss statements, project roadmap, cashflow forecast, pitch decks, founders’ bios, etc.

The entry of institutional investors into the crypto market has made this industry a less risky investment niche for venture funds compared to when only a handful of companies worldwide work with virtual assets.

The pros and cons of VC funding for crypto projects

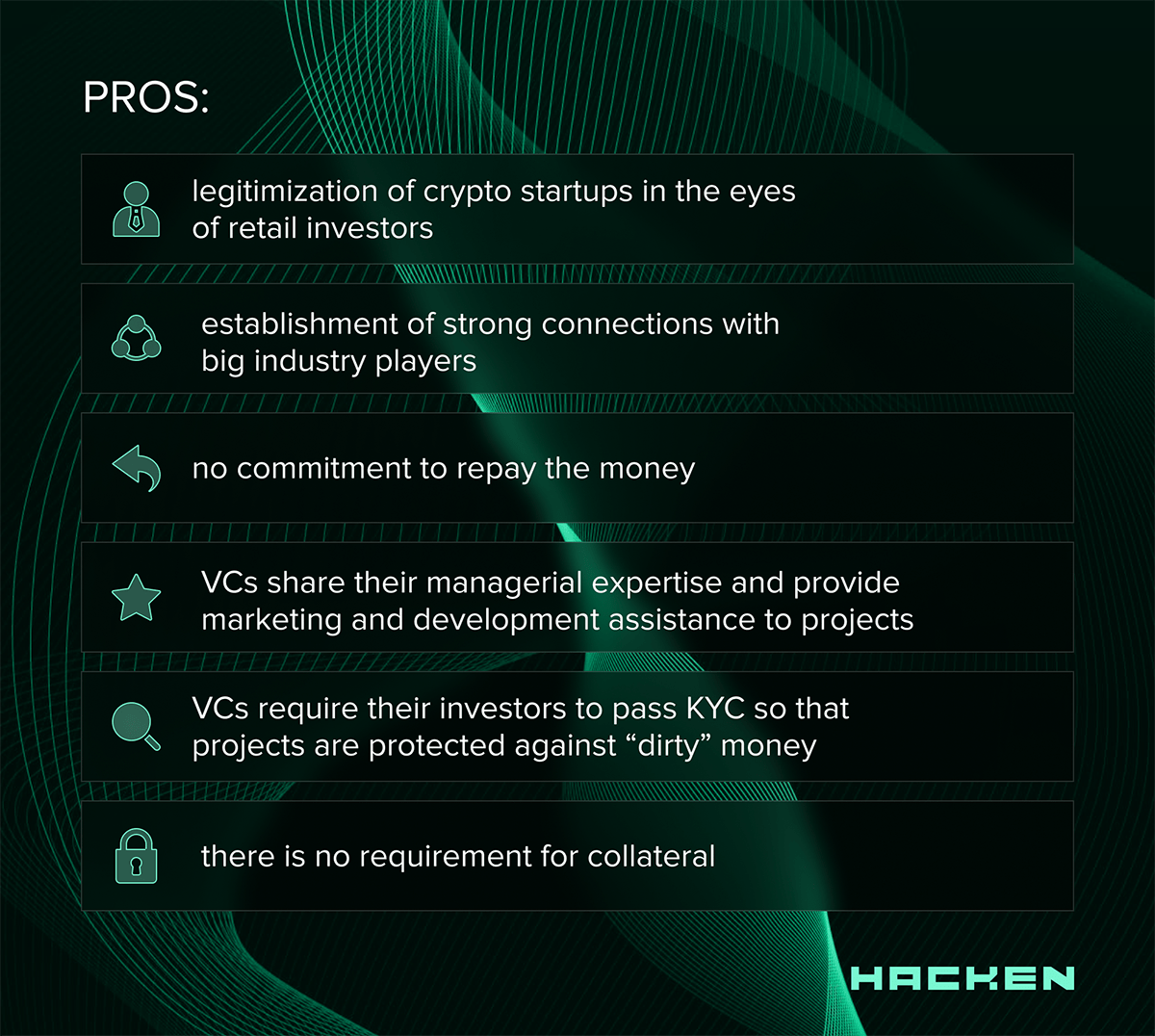

Pros:

- legitimization of crypto startups in the eyes of retail investors;

- establishment of solid connections with big industry players;

- no commitment to repay the money;

- VCs share their managerial expertise and provide marketing and development assistance to projects;

- VCs require their investors to pass KYC so that projects are protected against “dirty” money;

- there is no requirement for collateral.

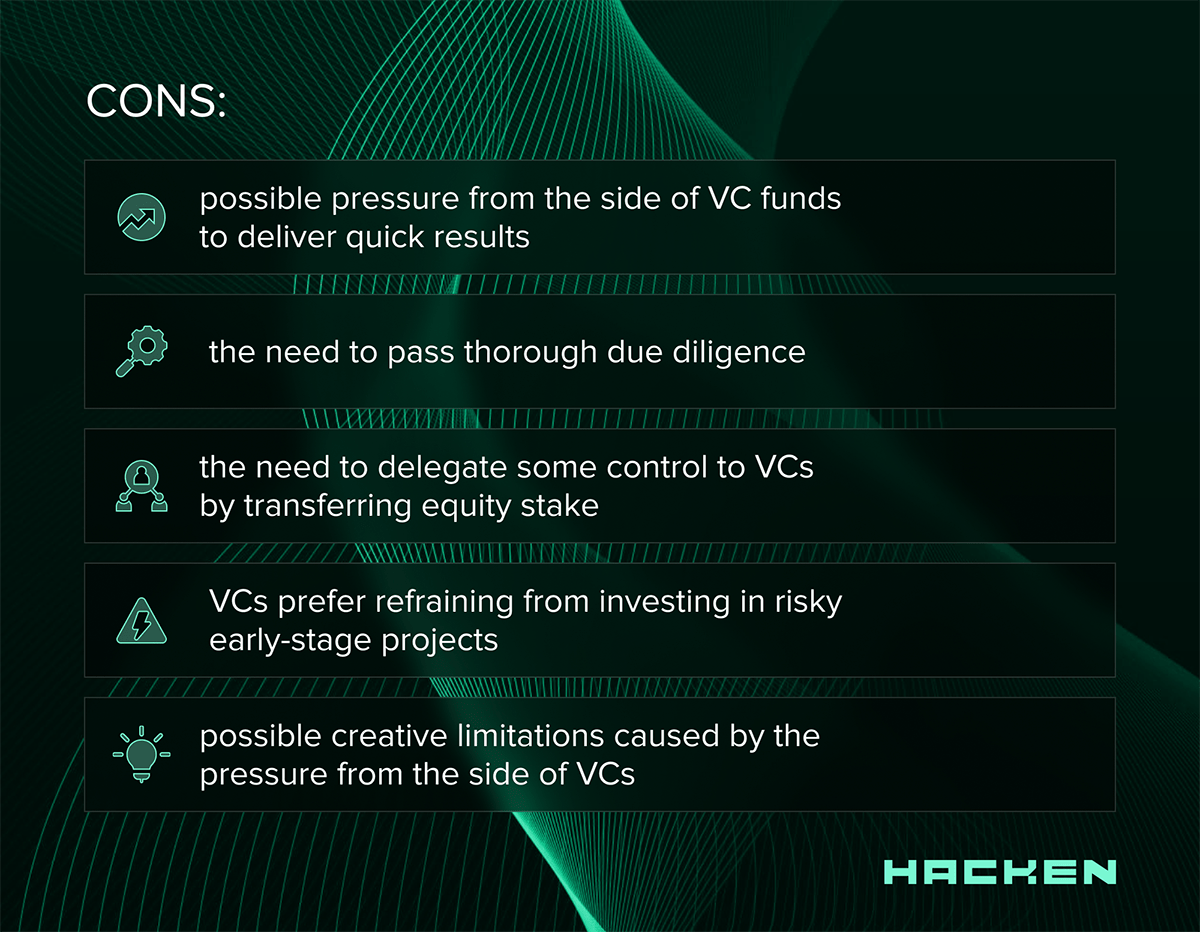

Cons:

- possible pressure from the side of VC funds to deliver quick results;

- the need to pass thorough due diligence;

- the need to delegate some control to VCs by transferring equity stake;

- VCs prefer refraining from investing in risky early-stage projects;

- possible creative limitations caused by the pressure from the side of VCs.

Types of VC funding

There are generally 3 broad types of VC funding for crypto projects:

Early-stage VC funding

This type of VC funding is subdivided into 3 categories:

- Seed VC funding

At this stage of its lifecycle, the product is just under development. Venture funds check the type of business model followed by a project and validate whether its idea has a chance to win the market. Venture funds allocate money primarily for market research and the creation of a sample product. The seed-stage projects mostly need initial capital to make their solution ready for demonstration to an external audience.

- Startup VC funding

At this stage, projects are given money for the initial setup covering office space, conducting further market research, and recruiting staff, especially developers and managers. VCs look at the project’s potential customer base. VCs need to make sure that a project will be able to expand its business. Startups need capital to develop first viable prototypes that would resemble their final solutions. Apart from capital, startups are interested in getting valuable industry expertise on how to successfully introduce their solutions to the general public and how to win first customers.

First-stage VC funding

This funding phase provides for raising financial assets for initial operations and basic production. Also, it covers the commercialization of a product and the establishment of effective sales management. At this stage, projects are interested in scaling their business to make it capable of serving the whole market. The key to reaching this goal is broad marketing coverage ranging from active social media advertising to participating in major industry events and meetups.

Later-stage funding

At this stage of financing, the project starts generating revenues and considers going public. The capital is used for strategic product improvement, expansionary marketing campaigns, industry cooperations and partnerships, and preparation for going public. At this stage, projects are interested in ensuring the ultimate transformation from a startup into a mature industry leader.

Top 5 Biggest Crypto Venture Funds

Over the last few years, several investment funds have grown into the biggest crypto VC investors:

Andreessen Horowitz

Also known as a16z, Andreessen Horowitz is the venture capital fund with $7.6B in total funds raised. The company will invest around $1.3B in seed rounds for startups and use $3B for venture investments. Apart from funding, a16z provides projects with industry research, engineering and security assistance, legal and regulatory support, recruiting services, go-to-market expertise, and educational content.

The fund’s portfolio includes such leading brands as Avalanche, Celo, Coinbase, MakerDAO, Matter Labs, Near, Opensea, Phantom, Uniswap, etc. The fund’s Twitter community unites around 660K users. One of the recent success cases of a16z is the decentralized data hub Golden which has raised $40M in series B funding. The fund is led by partners Chris Dixon, Sriram Krishnan, Arianna Simpson, and Ali Yahya. According to the statements made by the fund’s partner Arianna Simpson, a16z’s focus is made on investing in DeFi and gaming, and she notes that “Bear markets are often where the real work happens.”

Binance Labs

Binance Labs is a VC fund committed to supporting fast-executed technical teams focused on creating a positive impact on the general crypto space. Binance Labs has provided funding to 180+ projects from 25 countries. Their Twitter community is uniting more than 350K users worldwide. The fund’s portfolio includes such famous brands as Sky Mavies, Stepn, AnySwap, Coin98, 1inch, BitTorrent, FTX, Polygon, Travala.com, etc. The fund is led by Binance’s co-founder Yi He. According to the statement made by Binance CEO CZ, she “has played a pivotal role in identifying early-stage projects and founders with the vision and drive to disrupt those global institutions that no longer serve society effectively”.

Binance Labs manages around $7.5B comprised of projects from DeFi, NFT, and metaverse sectors. In June 2022, Binance Labs closed the $500M investment fund. It will focus on supporting projects in 3 stages: incubation, early-stage venture, and late-stage growth. This fund is supported by leading institutional investors such as DST Global Partners and Breyer Capital. The most recent investment case is the announcement of participation in the $300M series B funding round for Mysten Labs, the developer of Sui, a proof-of-stake permissionless layer-1 blockchain. Binance explains this recent decision by the motivation to support the projects working towards ensuring seamless user experience when working with blockchain-native products.

Since its inception in 2018, Binance Labs has brought its community a 2,100% rate of return.

Sequoia

Sequoia is an American Venture capital fund with operations in the USA, Southeast Asia, India, China, Israel, and European countries. Sequoia positions itself as a true believer in the founders of tomorrow’s legendary companies. Sequoia started its active expansion into the crypto market only in February 2022, when it announced the commitment to raise $500-$600M for its first crypto-focused fund. The major investments made by Sequoia are FTX, Fireblocks, CoinSwitch Kuber, Polygon, Magic Iden, and Iron Fish. Since its entry into crypto, Sequoia has backed more than 25 projects. In June 2022, it announced the launch of the 2 new funds: a $2B early-stage venture and an $850M fund for Southeast Asia. Sequoia Southeast Asia views Vietnam, the Philippines, Thailand, and Malaysia as the target markets for its investment due to high growth potential.

Sequoia Capital has built a big Twitter audience uniting more than 630K users worldwide. The key advantages of Sequoia capital are its deep market expertise and previous success cases since Sequoia has been among the first investors to work with such leading brands as Zoom, Apple, Airbnb, Instagram, and WhatsApp, to name a few. According to the statement made by Sequoia CEO, “Crypto moves so fast, crypto founders want to work with funds that can move incredibly fast, they want to work with funds that deeply understand their problems, deeply understand the landscape”.

Pantera

Pantera is a US institutional asset manager with a focus on blockchain technology. Pantera launched its first cryptocurrency fund in 2013. In total, there are $4.5B assets under management and since its entry into crypto, Pantera has made 100 venture and 110 early-stage token investments. Since 2013, Pantera Bitcoin Fund has been up by a tremendous 27,800%. The firm’s crypto portfolio includes such leading initiatives as 1inch, Arbitrum, BitGo, Bitstamp, Coinbase, Cosmos, FTX, Filecoin, Kyber Network, Near, and other brands. The fund’s Twitter audience has almost reached 150K users.

In September 2022, the founder of Pantera Dan Morehead, said that the company would invest in digital tokens and equity, including the shares the company already owned despite their value drop. To this end, Pantera is looking to raise $1.25B for its second blockchain fund. In his recent interview, Pantera’s founder noted that the crypto would inevitably gain huge popularity due to its monetary advantages.

Digital Currency Group

Digital Currency Group (DCG) is a New York based investment firm specializing in digital assets that invests in early-stage projects and matured businesses. DCG has invested in more than 150 companies across 30 countries. The most famous projects backed by DCG are Zeppelin, Ripple, Octopus Network, Kraken, HASHFLOW, Grayscale, Genesis, FTX, Fireblocks, Etherscan, Decentraland, Chainalysis, and other brands. DCG’s Twitter community unites around 130K users worldwide.

DCG’s CEO Barry Silbert believes that the new world’s largest cryptocurrency will emerge as the new safe haven asset. Also, Barry Silbert suggests that thanks to BlackRock’s bitcoin private trust, central banks will soon be able to safely invest in Bitcoin.

As one can see from the descriptions of the major crypto venture firms, they all strongly believe that the further skyrocketing growth of crypto is just a matter of time since these technologies win users’ trust due to their security, affordability, flexibility, and convenience.

How to choose a crypto VC fund? Primary recommendations

Choosing the right and reliable crypto fund for your project is the prerequisite for its long-term sustainable success. Below there are the primary rules for crypto managers to follow when deciding on a venture fund to partner with:

- analyze the brand’s history, including previous success cases;

- check whether your demanded amount of funding meets the VC’s investment criteria;

- find whether there are other projects from your industry in the VC’s portfolio;

- look at the biography of VC’s founders and check whether they meet the promises given to other projects and the industry in general;

- consider the feedback left by the projects that have worked with your chosen VCs;

- compare the business philosophy of your chosen crypto funds with your project’s mission and industry vision. If there are many parallels, then you have made a good choice.

Generally, by following these tips, crypto startups, as well as mature projects, can succeed in attracting capital for product development and market expansion.

Subscribe

to our

newsletter

Be the first to receive our latest company updates, Web3 security insights, and exclusive content curated for the blockchain enthusiasts.

Table of contents

Tell us about your project

Read next:

More related- How To Create An ERC-20 Token – A Step-by-Step Process

12 min read

Discover

- NFT Smart Contract Audit: Ultimate Guide

8 min read

Discover