What Goes Into Token Economy And Tokenomics Design

Tokenomics – a term tossed around the crypto world like confetti at a party, yet often misunderstood by many. Most whitepapers focus heavily on token distribution and unlocking schedules. But as a savvy crypto entrepreneur, you should know that these elements are merely the tip of the tokenomics iceberg. The broader scope of tokenomics encompasses a multitude of factors that, when understood and implemented correctly, can give your project that much-needed edge in the competitive crypto landscape.

@mattytokenomics

Token economics is a complex field that focuses on coordinating digital economies. It has many similarities with the traditional economy. You do not start a nation's economic planning by minting money and distributing it to random citizens, right? The same applies to digital blockchain-driven economies. It requires rigorous planning, and money distribution is just a minor part.

Instead of looking into tokenomics as vague pie chart distribution and unlock schedules, you can treat it as a field of digital economies where tokens are tools to influence user behavior.

Wrong Perception

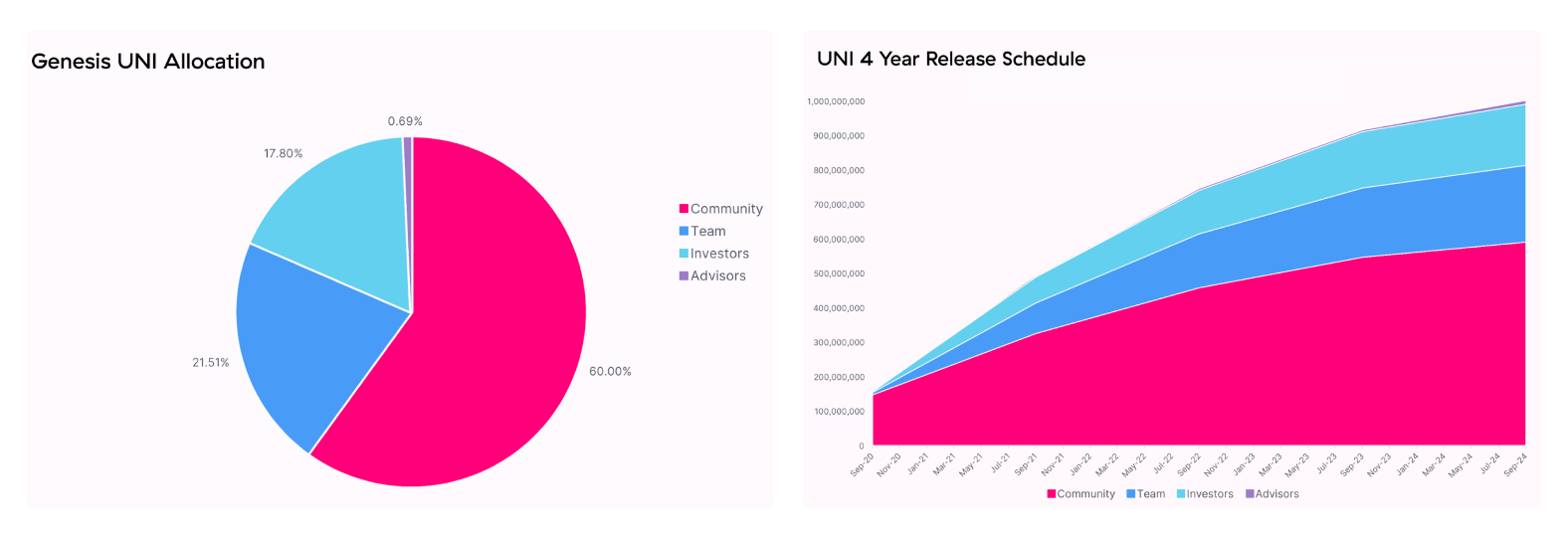

UNI token allocation and release schedule. Uniswap

Reality

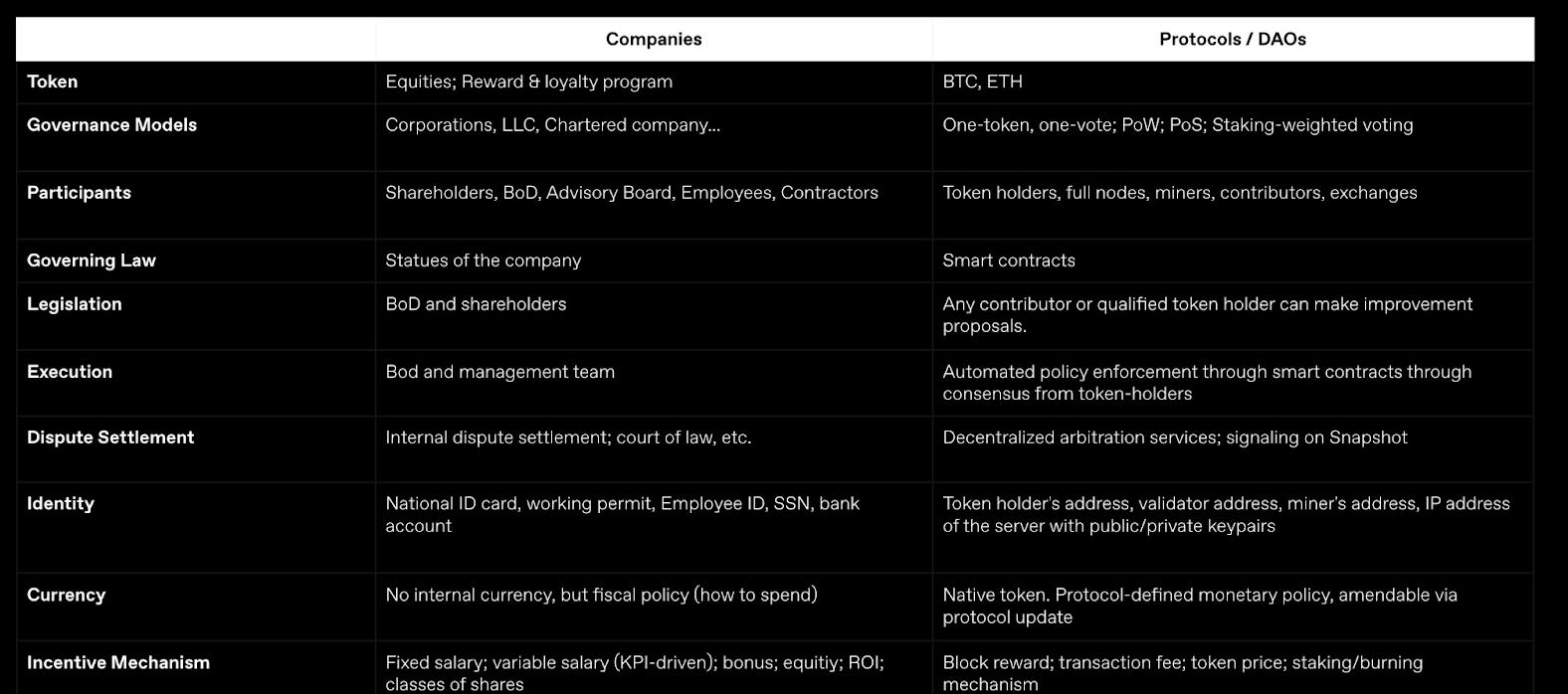

Comparing token and traditional economy. Not Boring

Why 95% Of Token Designs Are Bad And What Defines Good Tokenomics

The token economics design is a wild west: many pioneers are just beginning to explore uncharted territory. Only a few players know how to build, validate and maintain token economies. Greed-driven individuals blindly believe that implementing tokens and ICOs will magically solve all business issues, akin to a gold rush mentality. In reality, only some projects implement tokens with a solid strategy.

The reckless approach to tokenomics design ultimately dooms projects and fails their followers, so it's crucial to take a step back and think about your token's purpose and value.

When lacking the necessary knowledge, individuals tend to follow popular, flashy trends paying attention to the wrong aspects. Project owners commonly over-engineer the supply side while neglecting crucial factors, such as demand drivers, value creation, and aligned incentives.

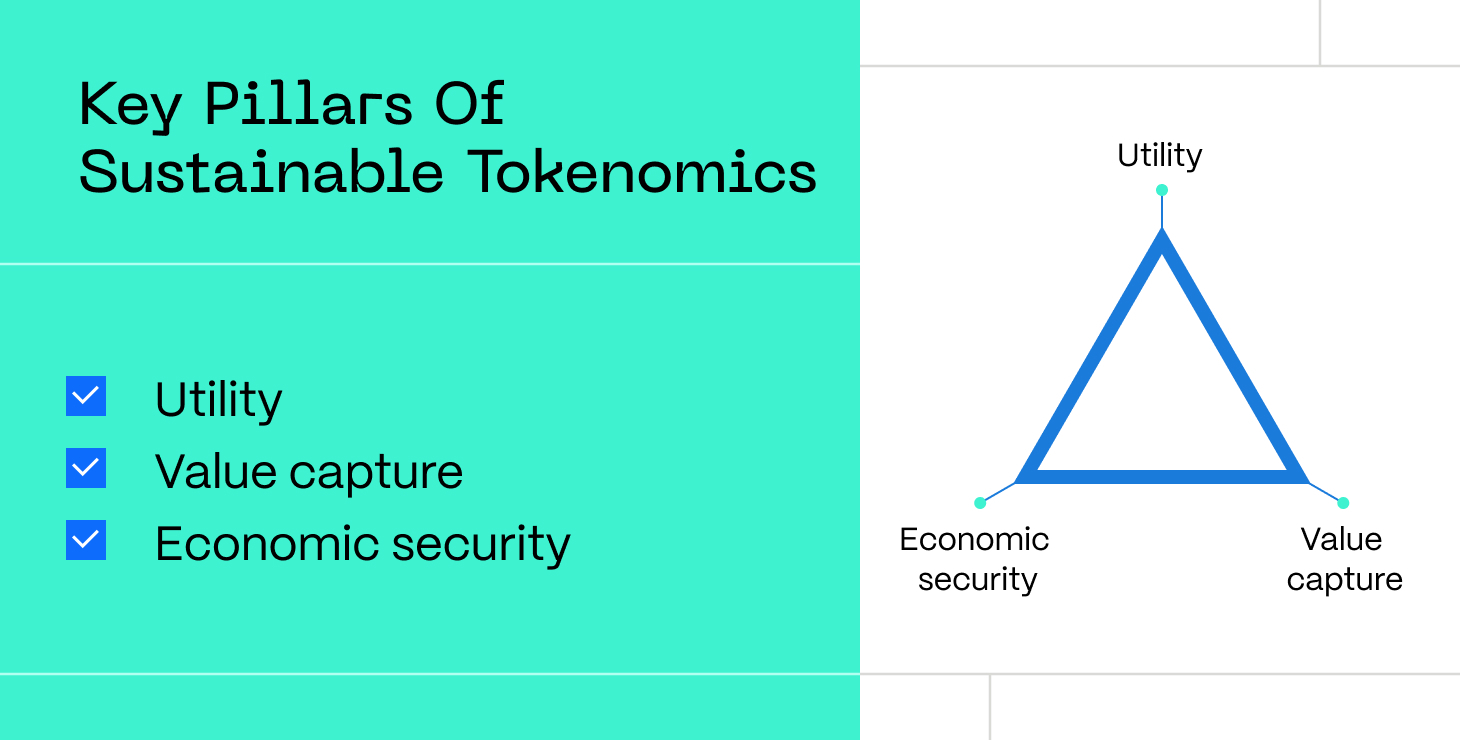

The core elements of well-planned tokenomics. @OfficialESC

Projects issuing tokens should adhere to the specific design principles to build a stable and sustainable token model that offers utility, captures value, and ensures economic security.

Design Principles For A Great Token Economy

Tokenomics design principles are vital for creating a sustainable and balanced economic model, ensuring that the underlying token serves its intended purpose, fosters equitable distribution, and maintains long-term value. By adhering to these principles, developers can create innovative incentive structures that encourage user adoption, facilitate a secure and efficient network, and promote overall ecosystem growth:

1. Ecosystem Design Over The Token Design

Many industry players start with tokens. However, tokens might not be necessary and could create friction. Designing a token economy with a token-first approach can be detrimental to any decentralized application (dApp) or protocol because it removes resources from the underlying functionality, value, and utility. By prioritizing the token, developers might be more likely to neglect user experience, security, and scalability, which are critical to long-term ecosystem success.

Excessive focus on a token also creates artificial demand or speculative bubbles, ultimately resulting in market volatility. This approach can stress the internal team excessively, causing them to worry more about the token price and community sentiment than the core product itself.

Instead, the project team should adopt a product-first mentality. With a value-driven approach, the token seamlessly complements and enhances the core functionality of the dApp or protocol. The product-first mentality creates an intrinsic link between token value and platform utility, fostering organic demand and sustainable growth.

On LooksRare, for example, as much as 90% of the activity consists of wash trading, where traders engage in this practice to earn $LOOKS rewards worth more than the fees they pay. Subsequently, they dump the $LOOKS to make a profit. Does the token benefit the project or make it worse? Sometimes, tokens can create unintended consequences and harm the project.

Wash trading at LooksRare NFT Platform. NFT Evening

2. Value Creation Aligned With Rewards

In tokenomics, reward alignment is the coordination of incentives for different stakeholders toward a common goal.

Aligning rewards with value creation is essential for building a thriving token economy. It fuels growth by engaging key innovators who contribute to project development. Rewarding value creation promotes adoption and fosters sustainable expansion. Honestly, this is the most essential principle since misaligning the incentives may distort the project economy and finally lead it to collapse.

We could divide tokenomics system rewards into two buckets: aligned and misaligned.

Aligned incentives. Well-aligned incentives create a self-sustaining ecosystem rewarding users for contributing to the network's growth and development. It can promote network security, encourage decentralized governance, and increase the value of the network's native token by reducing selling pressure on the market.

Look no further than Bitcoin for well-aligned incentives: miners contribute computational power to secure the network in exchange for new bitcoins.

Misaligned incentives. Wrong incentives create undesired outcomes undermining long-term viability and success. Such mechanisms concentrate power in the hands of a few stakeholders, reduce network security, and discourage user participation.

Airdrops are a well-known example of misaligned incentives. Users often dump the token they receive at the first chance. It's a zero-sum game in which the protocol receives no long-term value from token distribution and only wastes resources.

It is self-explanatory that you should choose aligned rewards if you want your protocol to flourish.

The key takeaway is to address and manage toxic behaviors rather than blindly hope a single good-mannered behavior will be enough to make your digital economy successful. Speaking of breaking overly optimistic lenses, it’s time we talk about malicious actors in your token model.

3. Toxic Behavior Limitation

Pay attention to potential toxic behavior, such as manipulation, fraud, or exploitation. Malevolent users – participants who knowingly undermine the credibility and integrity of your token economy – seek to profit from the imbalances and system failures.

For instance, malicious actors

- Manipulate rewards, which drives away honest participants who receive fewer incentives.

- Create pump-and-dump schemes, which leaves other investors with significant losses.

Such actions can erode trust, disrupt the ecosystem, cause a loss of value, and deteriorate the community.

Trust is crucial for the success of any token-based ecosystem. Toxic behavior left unchecked erodes trust, leading to a deteriorating community and hindering innovation, collaboration, and growth.

How To Tackle Toxic Users

Toxic behavior threatens your project's success, stability, and overall health. So do not perceive the token implementation process as a cuddly stuffed teddy bear stating: ‘I will implement discount and cashback because everyone loves it.’ By contrast, plan your economy to withstand the most deceptive person who always hides their true intentions. Start building your token model with edge cases and the most toxic users in mind – the ones who will stab you in the back with the giant machete.

Think as an engineer and prepare for the worst. Engineers design and test for extreme cases, and you should do the same to ensure the end product is robust and efficient under the most challenging conditions. It’s better to address issues before they can grow into significant issues. Planning for atypical cases ultimately saves time, money, and resources as it reduces the need for costly redesign.

Don’t think your token model design will be smooth sailing – better come prepared. A bunch of vague token features will not save the day. Always expect a long journey full of surprises. It is crucial to design token economies with built-in safeguards, incentive structures, and governance mechanisms that discourage toxic behaviors and promote positive contributions from participants. This approach fosters a healthy ecosystem, builds trust, and ensures the project's long-term success.

4. Token Demand > Supply

Projects should prioritize token demand drivers over supply-side mechanisms. By focusing on the utility and real-world applications, projects can ensure that their token's value remains intrinsically tied to the success and growth of the platform.

This principle underpins the following recommendations, which can help you maximize your token's potential and create a thriving ecosystem:

Foster organic demand. The key to success is to drive demand for your token. Creating a token with an optimal supply structure is essential; however, it's the demand side that ultimately determines the token's value and longevity in the market. Here, utility is king. A token with clear and valuable use cases, like governance rights or access to exclusive services, has higher adoption chances. The community loves tokens that bring utility, which drives demand.

Create a positive feedback loop. Consider your token's ability to capture value as the network grows. As the platform or protocol expands and gains more users, the token’s price should also appreciate. The appreciation creates positive feedback loops, increasing adoption and demand.

Prioritize incentive alignment. A booming token economy should prioritize incentive alignment among all stakeholders: users, developers, and investors. Positive reinforcement with participation rewards fosters a robust collaborative environment that drives organic demand and supports long-term growth.

Ultimately, even the most innovative supply-side strategies cannot compensate for the lack of demand drivers, and projects that neglect this crucial aspect risk collapsing in the long run. Therefore, fostering strong token demand is the key to building a thriving and sustainable token economy.

5. Choose Characteristics & Categories Based On Goals

Different Token Characteristics

Volatile and stable tokens serve different purposes within the crypto ecosystem. Understanding the differences and the intended use cases for each token type is essential for creating an effective tokenomics model.

Volatile & Unstable Assets

These assets are characterized by significant price fluctuations, making their value less predictable. However, they can still serve as a store of wealth and value accrual tokens.

Volatile assets often have the potential for significant price appreciation thanks to network effects, increasing adoption, and platform growth. Investors may see these assets as an opportunity to generate returns and accumulate wealth over time.

For example, Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and dApps. The native token, Ether (ETH), acts as a store of value within the ecosystem. Users pay transaction fees in ETH, and developers can use ETH to deploy smart contracts. As the Ethereum ecosystem grows, the demand for ETH increases, leading to value accrual. If the value of ETH were stable, it naturally couldn't serve as a store of wealth because, by design, it would fluctuate within narrow price boundaries.

Stable Assets

Stable assets, such as stablecoins, are designed to maintain value, typically pegged to a fiat currency. These assets are more fitting as the medium of exchange for the following reasons:

- Reduced Volatility. As stable assets maintain a relatively constant value, users can transact with confidence. The stability makes them suitable for trading, lending, and remittance.

- Predictability. Stability enables better financial decisions, as users can anticipate returns and plan their transactions accordingly.

- On- & Off-Ramp. Stable assets offer a reliable way for users to enter and exit the crypto market, as they can easily exchange for fiat or other cryptocurrencies without worrying about price fluctuations.

Volatile and unstable assets are more suited for value accrual and storage of wealth, while stable assets are more fitting for the medium of exchange use cases. Understanding this difference is crucial for navigating the crypto ecosystem.

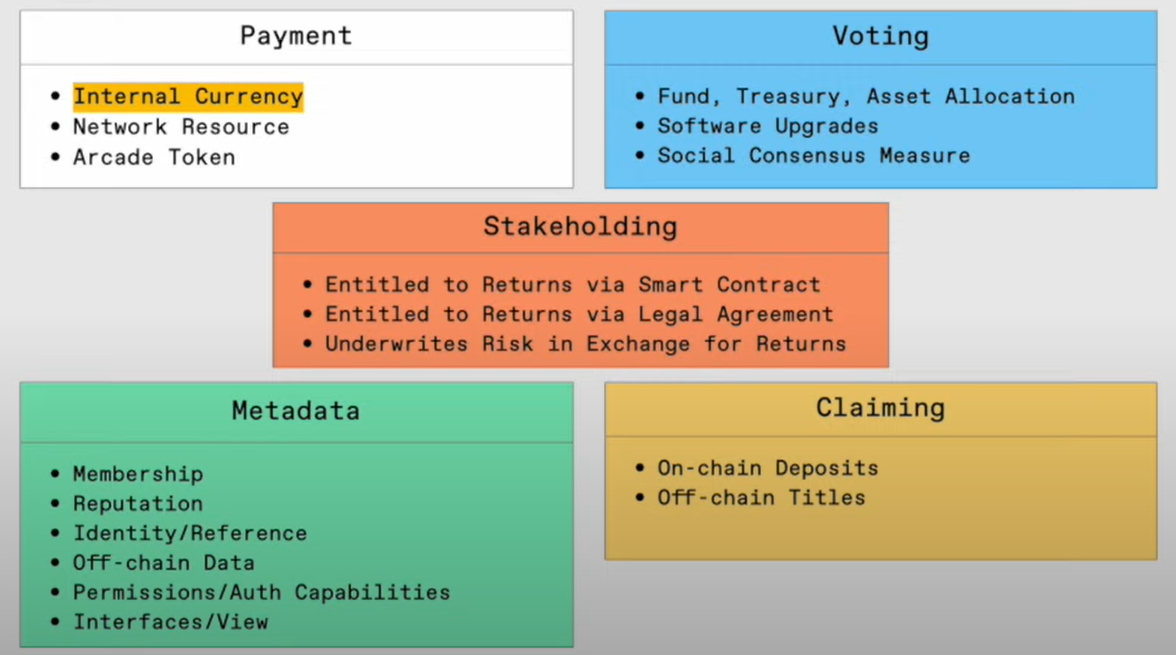

Different Tokenomics Categories

Token Design: Mental Models, Capabilities, and Emerging Design Spaces with Eddy Lazzarin. a16zcrypto

Tokens can be viewed as customizable Lego blocks creating diverse solutions depending on design goals and constraints. They serve multiple purposes, such as utility, governance, rewards, and digital assets.

Designers can align incentives and achieve desired outcomes by adjusting supply, distribution mechanisms, token burns, staking, etc. Furthermore, they can integrate tokens into various blockchain protocols, smart contracts, and dApps, expanding use cases and functionality.

Tokens are flexible building blocks. Crypto entrepreneurs who understand this can unleash their creativity and design innovative token economies that address specific challenges, drive user engagement, and foster project growth and sustainability.

A successful token economy design should be tailored to fit the following factors:

- target audience

- market conditions

- regulatory environment

- unique challenges & opportunities

Moreover, it is crucial to approach token design with a clear vision and a deep understanding of the ecosystem's needs to ensure that the created tokens add value and meaningfully contribute to the project's success.

Different Goals

Token goals can vary greatly depending on the project and its specific requirements. Here are three specific token goal examples: game economy, stablecoin, and value accrual token, along with explanations for each.

- Game Economy. Game economy tokens may be optimized for reward alignment. In this way, players who create the most value can be rewarded for completing tasks, quests, or achieving milestones, thereby incentivizing gameplay and fostering competition.

- Stablecoin. Stablecoins are designed to maintain a relatively stable value, typically pegged to a fiat currency like the US Dollar. So all the mechanisms and objectives are optimized toward maintaining the stability and peg.

- Value Accrual Token. Most DeFi projects utilize a value accrual token to capture and distribute the value generated within a platform or ecosystem.

Some token objectives may overlap with a project, but you should understand why it happens and determine whether you need the overlap. Carelessly copying other token economies will not work. For example, optimizing for value accrual may not be appropriate if your ecosystem requires a stable value token. It is crucial to carefully consider your project's unique needs and goals when designing a token economy.

Tools To Use To Design And Develop Your Token Economy

When designing token economies for Hacken clients, our tokenomics team likes to break down the process into 3 phases:

- Discovery

- Design

- Simulation & Optimization

Phase 1: Discovery

In the discovery phase, you research, brainstorm, and plan to understand what you want to build and how. Imagine you have a big box of Lego blocks and want to build something amazing with them. The token engineering discovery phase is the first step in building your Lego masterpiece.

First, you explore all the Lego blocks in your box (in this case, various token capabilities and functions). You think about what you want to create (your project's goals and objectives) and what kind of Lego structure you want to build (the token economy design).

Next, you look at the limitations, such as the number of pieces you have, their shapes, and colors (the design constraints). Finally, you also consider how your Lego creation should work and interact with other Lego structures (how your token will work within the broader ecosystem).

TOOLS/FRAMEWORKS TO USE:

Problem statement framework: A structured method for identifying and defining the problem the token economy intends to solve.

Whiteboarding and mind mapping: Collaborating and sketching ideas and relationships using tools like Miro or Lucidchart can help teams brainstorm and organize their thoughts.

Stakeholder analysis: Identify and understand the needs and motivations of key stakeholders within the tokenized ecosystem. Tools like stakeholder mapping and empathy maps can be helpful.

Incentive design: Develop incentives that drive desired behaviors within the tokenized ecosystem. Game theory and mechanism design are valuable frameworks for understanding and designing incentives.

Data analysis: Collect and analyze relevant data to understand the current state of the ecosystem and inform the design process. Use Python or R for data analysis and visualization.

Market research and competitive analysis: Identify trends and competitors in the market, and understand their strengths and weaknesses. Tools like Crunchbase, Google Trends, or Ahrefs can be helpful.

Community engagement: Collaborate and gather feedback from the community, as their involvement and support are critical to the success of a tokenized ecosystem. Tools like Discord, Telegram, or community forums can facilitate communication.

Project management: Keep track of tasks, deadlines, and progress using project management tools like Trello, Asana, or Notion.

Phase 2: Design

Think of the design stage as building a spaceship (your desired token economy) from the Lego blocks defined in the discovery phase. You must carefully follow the instructions and all the elements you’ve discovered before. You need to make sure everything fits together and works properly.

TOOLS/FRAMEWORKS TO USE:

Token Value Flow: Crypto-economic primitives are the fundamental building blocks in tokenized ecosystems. They define the core components and mechanisms that govern the behavior of participants and the flow of value within the system. To identify and analyze these primitives, you can use the tools of Whiteboarding and mind mapping (Miro or Lucidchart).

Mathematical equations used in mechanisms and primitives: Token-based incentive systems rely on various mathematical equations and models to define the mechanisms and primitives that govern them. To work with mathematical equations, consider using Python libraries such as NumPy, SciPy, and NetworkX for analysis and manipulation.

Phase 3: Simulation & Optimization

The simulation and optimization stage is like testing and refining a Lego spaceship. You now have a functional spaceship, but you still need to play with your creation and see how it works. You can tweak and adjust your invention to improve it, iterate the design to optimize its performance, and address any issues.

TOOLS/FRAMEWORKS TO USE:

Simulations: cadCAD provides a robust simulation environment to model and analyze the dynamics of a system under various conditions.

Essential Questions To Ask Before Launching Your Token

- Are your token capabilities and goals compatible with legal requirements?

- Does your project truly need tokens? Will they enhance the project or simply create more friction and problems?

- What are the specific goals and constraints of the token?

- Do you understand the roles and motivations of token economy participants?

- What tasks do token economy participants perform, and how do they create value for the business?

- What are the risks associated with tokens and the business? How can they be solved or at least mitigated?

- Who governs the protocol? What governance structures exist for the internal team and community?

- Is the token distribution and unlock schedule fair and transparent for all ecosystem stakeholders?

- What drives token demand?

- How are tokens removed from and reintroduced into the ecosystem?

At Hacken, we help Web3 entrepreneurs get definitive answers to these questions to design token economies that produce long-term value for projects and users.

After you create the tokenomics of your dream, verify its robustness and efficiency with a reputable auditor like Hacken to give your community and potential investors solid proof. Hacken provides external third-party verification recognized by major industry players with a new service called tokenomics audit.

Conclusions

The art of designing tokenomics is crucial if you ever want to create a thriving and sustainable cryptocurrency venture. Attention to detail is imperative, as developers must establish a token economy that harmonizes user incentives, cultivates long-lasting value, and integrates the token's practicality within the ecosystem. By incorporating best practices, experimenting with new approaches, and devising solid governance mechanisms, you can secure the foundation for a flourishing token economy.

Exceptional tokenomics garner trust and credibility among users and investors while fostering the overall advancement and resilience of the cryptocurrency domain. Only a robust tokenomics design structure brings confidence when navigating the dynamic world of digital currencies and trying to make an impact in the decentralized finance landscape.