With the recent all-time high of $73K and upcoming halving, Bitcoin is once again conquering the attention of the masses. The hardware-intensive proof of work architecture is secure but not scalable. The network can only process a few transactions per second, rendering it ineffective for everyday P2P exchange. Yet, things are changing, and we are not talking about a new token but a whole new dimension – Bitcoin Layer 2.

Layer 2 is an overlaying network that processes bundles of transactions off the main chain, lifting the heaviest jobs from the underlying network and thereby increasing overall throughput.

Why Bitcoin Needs Layer 2

According to the scalability trilemma, no network can be secure, decentralized, and fast all at once. Energy-intensive PoW Bitcoin is undoubtedly the most secure blockchain of all. More than 75,000 core nodes make it extremely decentralized. A trade-off? It cannot process more than 3-4 transactions per second.

Bitcoin was designed this way, and at the time of its creation 15 years ago, the numbers seemed sufficient. Satoshi Nakamoto suggested 10 minutes for block generation as an example, balancing network latency, propagation time, and computational efficiency. While the Segregated Witness (SegWit) upgrade did expand the block size, it’s still not enough. For comparison, Ethereum's block creation time is around 20 seconds.

Despite its leadership status, people don’t actually use Bitcoin as much as Ethereum or Uniswap for everyday transfers, even though the average transaction fee of $4.96 on the Bitcoin network is now two times lower than the $10.51 on Ethereum. As a result, most of the immense capital in Bitcoin remains unproductive and dormant. Moreover, the rise of NFTs on Bitcoin with Ordinals and BRC-20 only stressed the L1 network, creating more congestion and increasing fees.

While Bitcoin’s market dominance is around 50% right now, the figure has steadily declined over the long term. And the gap can become even larger. Ethereum is moving fast toward full data sharding (which can be truly game-changing, as explained in our post here), and Bitcoin cannot stay behind. External competition is pushing hard, calling for better scalability solutions.

Understanding Layer 2 Solutions

Layer 2 solutions are technologies built on top or alongside an underlying network that facilitate transactions off the main chain. The two most popular methods of implementing L2s are state channels and sidechains; others include merge-mined chains and proof-of-stake chains.

State Channels

A state channel is a protocol governed by smart contracts that create payment channels combining on-chain settlement and off-chain processes.

Sidechains

Sidechains are alternative blockchains where users typically send pre-existing BTC (as wrapped coins) to participate. Inside a sidechain, users can transact however they want. Transfers from sidechains back to the mainchain occur via conjecture-and-refutation (i.e. asserting and gradually confirming transactions over time), ensuring a 1:1 ratio between sidechain and BTC market prices.

Top Bitcoin Layer 2s

Lightning Network

Lightning Network (LN) facilitates fast Bitcoin transfers with near-zero fees. It works by setting up payment channels between senders and receivers, using multi-signature transactions and time locks. Payment channels are basically deposit boxes where funds are stored for a specific group of individuals that transact between themselves off-chain.

Transactions on LN “hop” through channels between nodes to reach their destination. To facilitate this, it employs onion routing, similar to Tor relays. As a result, LN offers a high degree of anonymity.

Historical Context

An important point: LN has a long history of support in the Bitcoin community. Satoshi Nakamoto conveyed the idea of using channels for high-frequency trading; later, Mike Hearn expanded on this idea. In 2016, the whitepaper was published, and dozens of developers reached a consensus on LN’s direction at Scaling Bitcoin Milan. In 2017, SegWit was implemented as a final milestone before the launch of LN.

Lightning Limitations

Theoretically, LN can handle millions of transactions per second, but LN adoption is yet to reach these levels. LN's total value locked (TVL) is $309 million.

Because of the near-zero fees on LN, nodes don’t have many incentives to keep running. Nodes can go offline, and channels can be closed unilaterally, posing security risks. Large-sum transactions are impractical. Moreover, Bitcoin price movements mean that most people don’t hold their BTC for too long in LN channels, moving them back and forth instead (each channel creation requires a separate on-chain transaction).

Overall, the Lightning Network has not emerged as the ultimate solution to Bitcoin's scalability, primarily due to design and operational challenges. Many even consider it an outdated solution. It doesn’t have smart contracts by default (the RGB project works on bringing smart contracts on Bitcoin through LN). However, it is arguably the best Bitcoin Layer 2 solution available, or at least the most widely used.

Liquid Network

Liquid Network is the biggest L2 Bitcoin sidechain with $260M in TVL. It was launched by Blockstream in 2018. Block creation takes 1-2 minutes; speed comes at the expense of high centralization. Indeed, the sidechain serves as a Bitcoin settlement mechanism for various trusted parties (mostly businesses like exchanges and market-makers). It uses a wrapped 1:1 version of Bitcoin called L-BTC as a currency and operates as a private chain. At its core, Liquid Network functions similarly to a bridge, where there is a corresponding L-BTC for every BTC.

Liquid Limitations

Liquid Network doesn’t actually solve the scalability trilemma as it is not sufficiently decentralized. Among the 3,836 BTC in TVL, 99.5%, or 3,817 BTC, are stored in one address, bc1…ff4aj4. This level of centralization is due to its design as a federation. An honest critique of Liquid is that it kind of defeats the purpose of crypto with 60 or so members.

Overall, Liquid Network is less suitable for retail investors and has a high requirement for counterparty trust. Still, Liquid hopes to get everyday users on board by allowing any-time swaps (i.e., via the AQUA wallet) or tokenizing various assets inside its chain.

Rootstock (RSK)

Rootstock is another Bitcoin sidechain and has 2,721 BTC in TVL. For every BTC sent to RSK, it issues a token called RBTC, maintaining a 1:1 peg. The main difference from Liquid is RSK’s focus on smart contracts. Indeed, the blockchain is EVM-compatible, meaning it can host common DeFi applications (e.g., lend, borrow, stake). According to its updated whitepaper, a new block can be generated in 30 seconds, and the max TPS is 10.

RSK applies a comprehensive approach focusing on users, developers, and miners to grow its ecosystem. Among its strengths are user-friendly design and the support of dozens of wallets/dApps to make RBTC-BTC swaps easy. For developers, it offers $2.5 million in grants. RSK positions itself as a low-hanging fruit for existing Bitcoin miners. In particular, miners can earn high rewards with the same infrastructure in a process called merged mining. In 2023, Uniswap expanded to RSK.

Rootstock Limitations

Since its launch almost a decade ago, RSK is yet to conquer the masses (even though it’s one of the most popular L2s). Public reception aside, it can be argued that bringing Ethereum smart contracts into the mix makes RBTC owners more prone to hacks than just holding onto BTC. Projects deploying to Rootstock must ensure their smart contracts don’t contain any vulnerabilities with third party audits. On top of that, the state of network decentralization remains unknown as data is not readily available. Let’s not forget that RSK was set up as a federation. As a result, it depends on centralized custodians for security.

Stacks Network (STX)

Stacks is a Bitcoin Layer-2 sidechain with $155M in TVL. It employs a Proof of Transfer (PoX) consensus and uses a native STX token as a currency. Staking is integral for the activation of the PoX mechanism. STX holders stake their tokens and earn BTC in rewards. Similar to RSK, Stacks offers smart contract support; but it uses Clarity as a programming language. Among its strengths is a fairly developed ecosystem with dozens of apps and tools and an active developer community. Moreover, STX is among the top 25 most valuable cryptocurrencies in the world.

How stacking supports PoX?

The Proof of Transfer (PoX) mechanism relies on network stability for activation. Miners confirm a PoX anchor block during a "prepare phase" to initiate the reward cycle. The choice of the anchor block determines the PoX reward set, but miners need it in their chainstate to mine blocks descending from it. If a PoX anchor block goes missing, a recovery procedure outlined in SIP-007 involves miners "forking around" it by mining a chain through Proof of Burn (PoB). The system design addresses this problem by encouraging stacking, thereby helping miners determine if a missing block is truly unavailable or just not propagated to them.

Stacks Limitations

Miners compete using cryptographic sortition via weighted cryptographic selection to append blocks. For context, sortition is a decentralized method for selecting participants using cryptography, which is essential for consensus.

In the current model, slow Bitcoin blocks and Stacks forks disrupt on-chain apps due to the block production rate being tied to Bitcoin's rate, resulting in high transaction confirmation latency. The current settlement time is 10-30 minutes. Microblocks are ineffective in speeding up transaction times due to uncertainty in confirmation until the next sortition, leading to orphaned transactions. Additionally, Stacks forks being untied to Bitcoin forks enable cheap reorgs, compounded by poorly-connected miners manipulating sortition outcomes by excluding others' block-commits from Bitcoin blocks. Luckily, Stacks is well aware of these and is addressing them in Nakamoto upgrade and relevant SIPs.

What’s Promised in Nakamoto?

Nakamoto's proposed breaking change is to separate block production from cryptographic sortitions, so the transaction confirmation time will decrease to seconds. Stacks will no longer fork independently after transaction confirmation, ensuring transaction reversal is as challenging as reversing a Bitcoin transaction. Additionally, alterations to the sortition algorithm prevent Bitcoin miners from gaining an advantage as Stacks miners. These changes include decoupling Stacks tenure changes from Bitcoin block arrivals, requiring collaboration among stackers to validate and sign each Nakamoto Stacks block, and adopting a Bitcoin MEV solution to penalize block-commit censorship.

Overall, with the Nakamoto upgrade, Stacks L2 hopes to bring increased transaction throughput and 100% transaction finality. It’s a promising development that can elevate Stacks into the most refined Layer 2 solution.

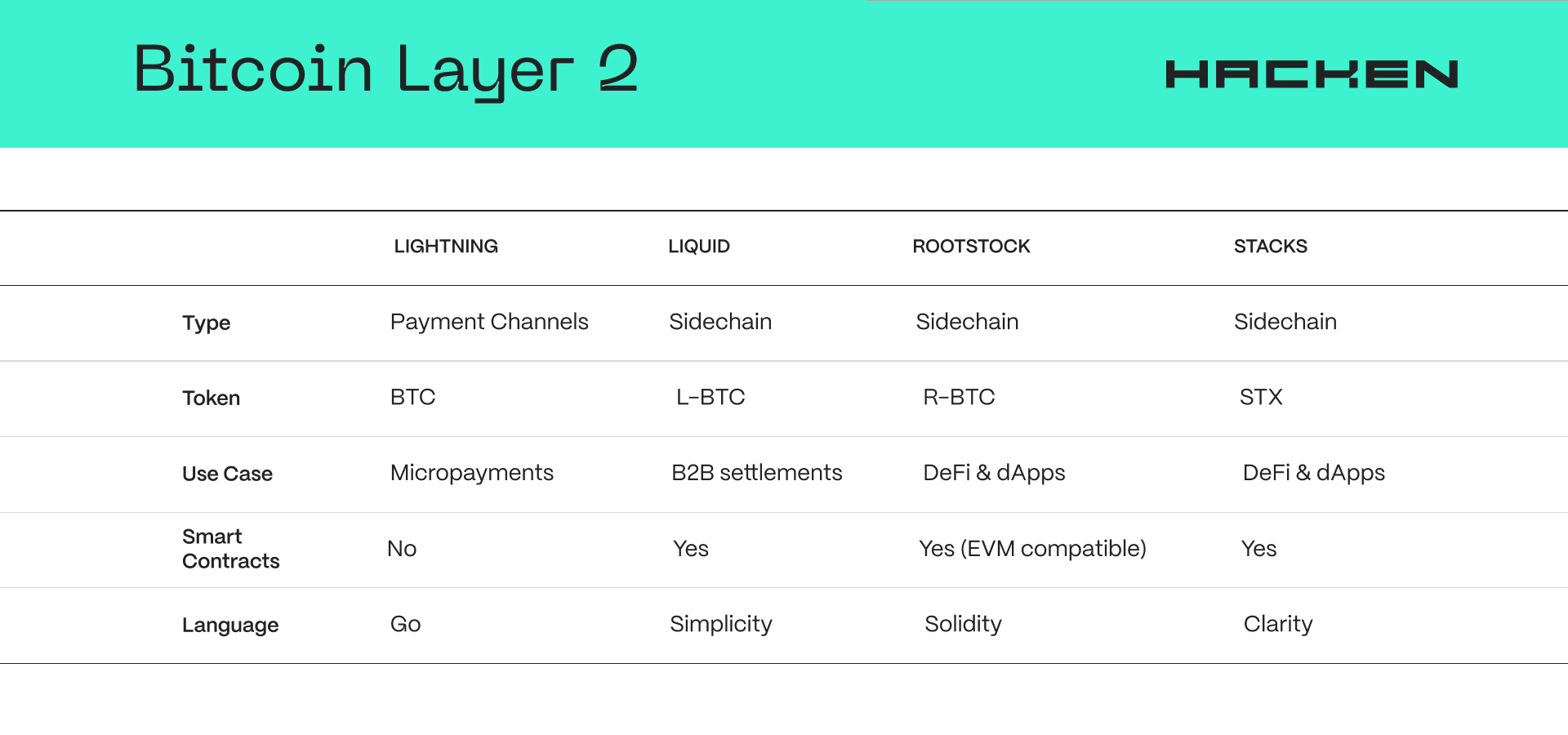

Comparing Bitcoin Layer 2 Solutions