TRUST Summit 2025 Recap

Thank you to the leaders who joined us at Nasdaq MarketSite to shape the future of secure digital asset adoption. TRUST Summit returns in 2026 — join the waitlist to be the first to know.

Inside TRUST Summit 2025

Captured at TRUST Summit 2025

From the stage

Expert insights on security, compliance, and digital assets.

Hacken TRUST Summit 2025 | Security as a Journey: Building Infrastructure for Scale and Trust

9:45

Dec 22, 2025

Hacken TRUST Summit 2025 | The Bedrock of Trust: Tokenization and the Future of Market Integrity

13:49

Dec 26, 2025

Hacken TRUST Summit 2025 | Building Secure Stablecoin Ecosystems

30:42

Dec 24, 2025

Media highlights

TRUST Summit 2025: Hacken brings global leaders to Nasdaq to define the future of digital asset security

AlphaTON Capital Takes Center Stage at TRUST Summit 2025 to Shape the Future of Digital Finance

TRUST Summit 2025: Hacken brings global leaders to Nasdaq to define

TRUST Summit 2025: Hacken Brings Global Leaders to Nasdaq to Define the Future of Digital Asset Security

Who we brought together

Featured voices from TRUST Summit 2025

What we covered

Digital Assets Tokenization

Institution-grade architectures for RWAs, stablecoins, and regulated digital assets – governed, auditable, and built to scale.

Regulatory Strategy & Resilience

Security-led operating models that meet evolving rules while preserving market integrity and continuity.

Security Infrastructure

Security-by-design across the stack – key and identity management, monitoring, and incident response enabling trusted DePIN and digital asset adoption.

AI & Emerging Threats

Governance and defense for agentic systems – adversarial testing, threat modeling, and controls for new attack surfaces.

“We’re convening the leaders shaping adoption, regulation, and institutional security for digital assets.“

TRUST Summit 2025 – Agenda

Networking Breakfast

Arrival & networking breakfast to connect speakers, regulators, and institutional leaders before the program begins.

Part I

Security as a Journey: Building Infrastructure for Scale and Trust

Framing security as the foundation for institutional adoption and scalability in digital assets.

Yev Broshevan

CEO & Co-Founder, Hacken

The Bedrock of Trust: Tokenization and the Future of Market Integrity

Before we can build the future of digital assets, we must trust the foundation. This opening fireside chat brings together an architect of market infrastructure, Chuck Mack of Nasdaq, and an advocate of its cryptographic integrity, Yevheniia Broshevan of Hacken as the moderator. They will cut through the hype to address a core question: As real-world assets become tokenized, how do we ensure the underlying systems are as resilient and reliable as the traditional markets we rely on today? This is a strategic dialogue about building market operations that are not just innovative, but inherently trustworthy.

Yev Broshevan

CEO & Co-Founder, Hacken

Chuck Mack

Senior Vice President, North American Markets, Nasdaq

Mapping Risk in Digital Assets

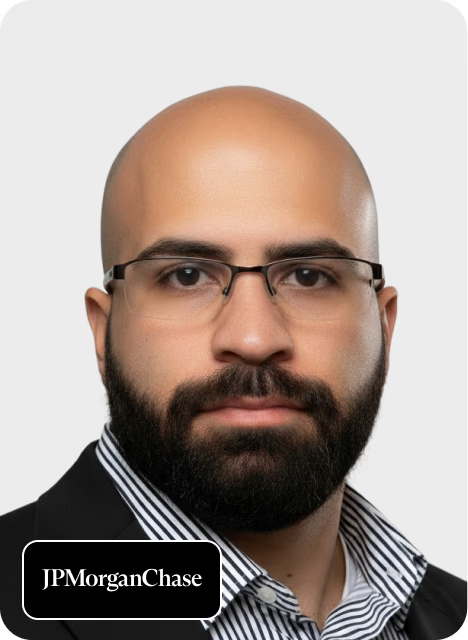

As traditional finance and blockchain converge, risk itself is being redefined. Leaders from Moody's, Metrika, J.P. Morgan Chase, and Citi share how institutions assess technology, credit, and cyber risk — and what's missing for continuous assurance.

Sal Ternullo

ModeratorManaging Partner, A100x Ventures

Rajeev Bamra

Head of Strategy, Digital Economy Moody's Ratings

Nikos Andrikogiannopoulos

Founder & CEO, Metrika

Chaddy Huussin

Executive Director, J.P. Morgan Chase

Ryan Rugg

Global Head of Digital Assets, Treasury & Trade Solutions, Citi

Tokenization: Risk & Resilience

Tokenization is transforming how assets are issued, traded, and settled — but also exposing new layers of risk that traditional market frameworks weren't built to handle. This session explores how security, regulation, and interoperability must evolve to protect tokenized real-world assets (RWAs), stablecoins, and securities at scale.

Dennis O'Connell

ModeratorPresident, ERC3643 Association

Charles Jansen

Managing Director, Head of DeFi Transformation, S&P Global

Martin Quensel

Co-Founder, Centrifuge

Otto Niño

Technical Business Development Director, DTCC Digital Assets

CJ Rinaldi

Chief Compliance Officer, Kraken

Networking Break

Mid-morning networking and discussion.

Expert webinars held in the lead-up to TRUST Summit 2025

Explore the online sessions presented in the weeks leading up to TRUST Summit 2025, featuring insights from our speakers and industry leaders.

TRUST Summit returns in 2026

An invite-only forum for leaders shaping secure digital adoption.

Why attend:

- Insight from regulators & institutions

- Key updates on compliance and security

- High-level networking

Interested in speaking or sponsoring? Contact us at [email protected]

About Hacken

Hacken is an end-to-end blockchain security & compliance partner on a mission to make Web3 a safer place.

Subscribe to our newsletter

Be the first to receive our latest company updates, Web3 security insights, and exclusive content curated for the blockchain enthusiasts.