The European Union’s Markets in Crypto-Assets (MiCA) unified framework was developed in response to the rising adoption of digital assets, cryptocurrencies, and blockchain technology. It’s framework provides a single set of rules that apply to all EU member states, creating consistency for crypto service providers, businesses, and investors.

By establishing consistency for crypto service providers, businesses, investors, and other entities, MiCA aims to deliver trust, stability, and security to the once fragmented and often volatile crypto industry.

What Is MiCA?

MiCA is the EU’s framework for regulating crypto-assets and service providers. It creates clearly defined compliance rules and crypto-asset definitions, improves consumer protection, and encourages innovation by establishing regulatory clarity.

Also referred to as the Markets in Crypto-Assets Regulation (MICAR), the EU’s crypto-asset regulation implements uniform market rules for the crypto industry, covering assets not regulated by existing financial services legislation. Its key purpose is to regulate public offerings of crypto-assets by establishing compliance requirements for those issuing and trading crypto-assets.

MiCA aims to address the gaps in existing financial regulations, ensuring that the growth and integrity of crypto markets are maintained and that consumers are protected before, during, and after exiting. By harmonizing regulatory requirements for all EU member states, MiCA unburdens crypto businesses of jurisdictional differences while reducing associated costs and legality considerations.

“Moreover, MiCA’s potential influence extends beyond the borders of the European Union. Given the EU’s stature in the global financial ecosystem, the successful implementation of MiCA might serve as a blueprint for other jurisdictions” (Conlon, Corbet, & Oxley, 2024, p. 17).

With the inclusion of mandatory whitepapers, consumers can review a business's operations and fundamentals before committing to get involved. This helps protect users from fraud, scams, and unexpected outcomes while creating a more trustworthy space for the crypto industry.

MiCA Implementation Timeline

MiCA’s implementation of its regulatory framework across the EU is set to take a phased approach, which began in 2023. Below is a breakdown of the key dates and implications of its steady rollout:

2023:

- April 20, 2023: MiCA was formerly ratified and adopted by the EU, making the EU the first extensive jurisdiction to pass a regulatory framework for crypto-assets.

- June 2023: MiCA was published in the Official Journal of the European Union on June 9 and came into force on June 20, including many measures that must be developed within a 12-18 month deadline.

- The European Securities and Markets Authority (ESMA) began preparing technical standards and guidelines to specify the implementation of the regulation.

- National Competent Authorities (NCAs) and market participants were encouraged to begin planning for the transition to prevent future disruptions.

2024:

- June 30, 2024: Provisions relating to stablecoins, including Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs), began to apply.

- December 30, 2024: Crypto-asset service providers (CASPs) must obtain MiCA authorization to operate across the EU and benefit from passporting rights.

2025:

- CASPs must fully align their practices with MiCA’s framework within an 18-month transition period to ensure compliance and avoid legal enforcement actions.

- This transition period is different for some countries, with the Netherlands opting for a shorter July 1, 2025 compliance deadline, Italy by Dec. 30, 2025, and Germany and Austria by Dec. 31, 2025.

- NCAs receive full enforcement powers to oversee compliance and prevent regulatory arbitrage or illicit activities in EU crypto markets.

MiCA Regulation Scope

The MiCA framework provides clear regulatory guidelines and definitions for crypto-assets and services across the EU. The framework’s scope is extensive, bringing legal clarity and impact to several crypto-asset categories. However, it doesn’t bring full regulatory clarity to some elements of the crypto industry, such as non-fungible tokens (NFTs) and decentralized finance (DeFi).

Crypto-Assets Regulated Under MiCA

MiCA regulates three primary categories of crypto-assets: ARTs, EMTS and all other crypto assets.

Asset-referenced tokens (ARTs), commonly called “stablecoins,” are designed to remain stable in value by being begged to multiple other assets, such as fiat currencies or commodities. ARTs function as a medium of exchange that is used for payments and cross-border transactions.

- Example: A token backed by multiple fiat currencies like the Euro and the US dollar would fall under the ART category.

Electronic money tokens (e-tokens money or EMTs) represent a single fiat currency and function similarly to electronic money, such as a Euro-backed digital token issued by an authorized institution. These regulated crypto-assets function as digital equivalents to traditional fiat currencies, but unlike ARTs, EMTs are backed solely by one fiat currency. EMT issuers must meet strict compliance standards and be authorized credit or electronic money institutions.

- Example: The Euro-pegged stablecoin by Circle (EURC) would be considered an EMT as it is backed 1:1 by the euro and functions as a digital representation of the fiat currency.

The third category that MiCA regulates encompasses all other crypto-assets that do not belong to the ART or EMT classifications. These could include the likes of utility tokens that provide holders with access to platforms or services rather than functioning as a medium to facilitate currency exchange.

- Example: A token that enables users to access a private group or service would fall under this third category.

Exclusions From MiCA Regulation

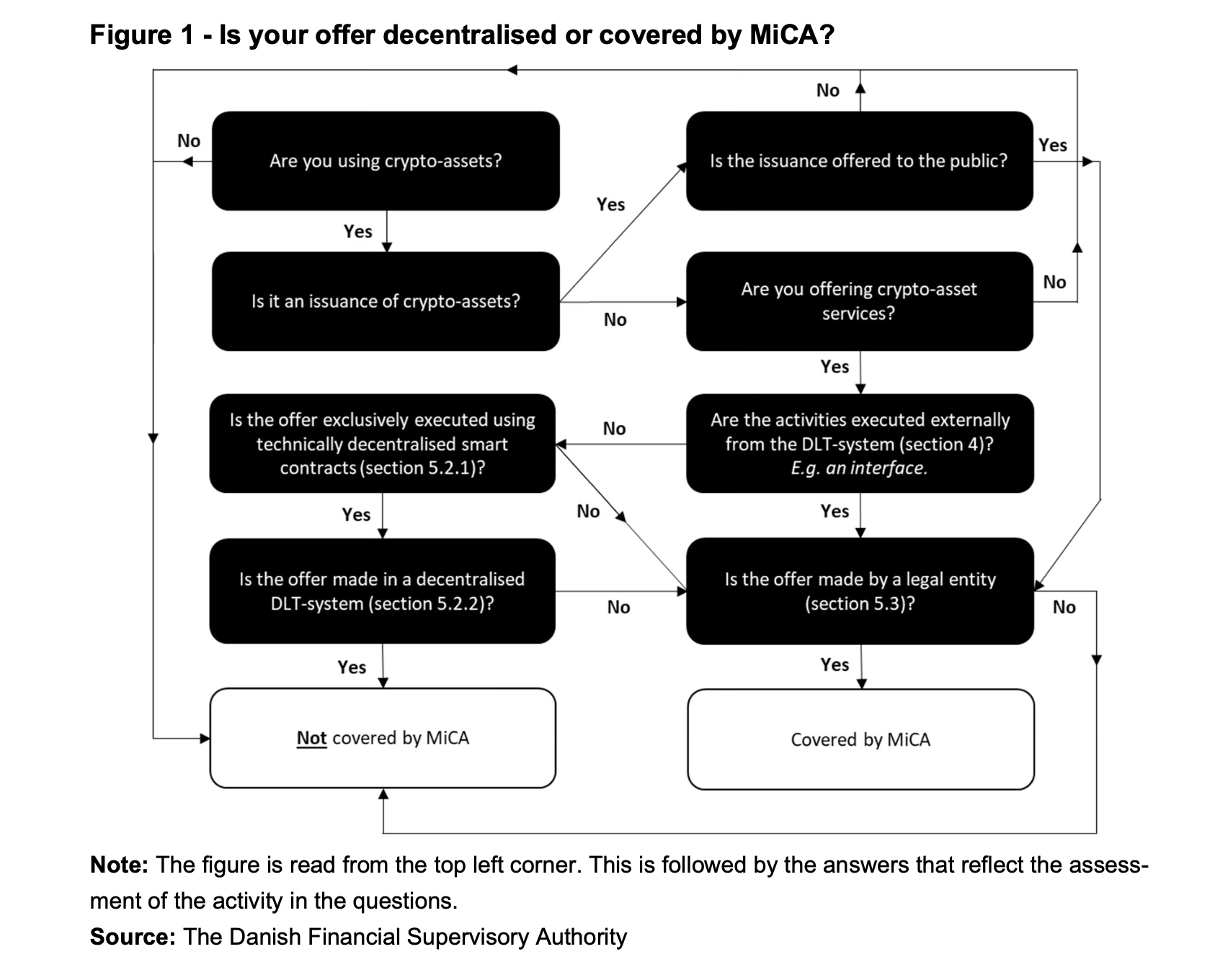

To be excluded from MiCA, the offer must be technically and governance-wise decentralised — meaning it must run exclusively via smart contracts and on a decentralised DLT system, with no legal entity acting as a counterparty. Market participants need to carefully assess not only the technology but also the governance structure and interface layer of their offering governance structure and interface layer of their offering,

Under MiCA’s framework, DeFi services that are fully decentralized with minimal or no intermediaries and NFTs are explicitly excluded from its regulatory scope. Unlike the clear rules set for the crypto-assets mentioned above, these two sectors of the crypto industry remain in muddy waters for service providers interacting with EU member states.

DeFi platforms and service providers operate without intermediaries and rely on smart contracts and/or decentralized protocols to enable trading, lending, borrowing, and other activities. MiCA cannot be applied in these cases because no identifiable entity manages the systems; therefore, they remain unregulated.

However, in circumstances where there is only partial decentralization and an identifiable intermediary managing its primary functions, MiCA may be applied.

- Example: A partially decentralized stablecoin with a centralized issuer managing its reserves, such as Tether’s USDT or Circle’s USDC, being used within EU markets.

Due to the non-fungible nature of NFTs, they are not regulated under MiCA due to the inability to peg them to a stable value medium. NFTs are not readily interchangeable, and their value cannot be ascertained compared to an equivalent asset or existing market.

However, MiCA may apply to an NFT issuer and the platform it’s traded on if it is characteristically similar to the three primary regulated categories mentioned in the previous section.

- Example: NFTs issued in a large series or as a collection could be considered fungible and become subject to MiCA’s regulatory requirements.

MiCA also explicitly excludes blockchain-related assets already regulated under pre-existing financial legislation, such as securities, deposits, structured deposits, funds, and securitization positions. Assets tied to life insurance, pensions, and social security schemes are also excluded from its scope.

Non-fractionalized NFTs linked to unique physical or digital assets, Central Bank Digital Currencies (CBDCs), and non-transferable tokens are excluded from the MiCA framework’s scope.

These exclusions align with the regulatory framework’s goal of focusing on unregulated crypto-assets with significant consumer protection risks. MiCA ensures it addresses areas that lack legal clarity without overlapping with assets governed by other financial directives or assets with limited functionality.

Key Requirements of MiCA Regulation

There are four key requirements of the MiCA regulation that CASPs and institutions must adhere to when providing crypto-related services to users within the EU’s jurisdiction.

Issuance of Crypto-Assets

MiCA mandates that any entity that issues crypto-assets must publish and provide consumers with a detailed whitepaper outlining the asset's purpose, its underlying technology, associated risks, and other relevant information. This mandate ensures transparency for potential investors so they may make more informed decisions and be aware of the potential pitfalls.

Utility tokens that grant access to an existing or functioning product or service are exempt from MiCA’s regulatory requirements for public offerings of crypto-assets (except for ARTs or EMTs). To qualify for this exemption, the token must provide access to a product or service currently available on the market or actively in use, rather than to a future promise or development.

By requiring issuers to remain compliant with these standards, MiCA reduces the risks associated with crypto-assets where there is misinformation or a lack of information. Issuer disclosures help minimize fraud risks and establish credibility and trust in the crypto industry.

Rules for Crypto-Asset Service Providers (CASPs)

CASPs must acquire licenses by meeting operational standards set by MiCA, which allow them to operate within the EU. These standards include meeting cybersecurity measures to protect users and investors, ensuring strong governance structures, and complying with anti-money laundering (AML) and counter-terrorism financing (CTF) obligations.

CASPs must meet licensing criteria, which include providing proof of financial stability, appointing qualified personnel, and conducting customer due diligence (CDD).

For wallets, exchanges, and other service providers, the MiCA rules for CASPs standardize practices across the EU and improve consumer protections. For exchanges, MiCA introduces fair pricing, custodial safeguards, and secure trading platform requirements, while wallet providers must enhance their security protocols and safeguard measures of user funds held.

Consumer Protection in MiCA Regulation

MiCA establishes measures to protect consumers and improve trust and security in crypto-asset services and requires that CASPs and issuers provide clear and accurate information about their services and products, such as pricing, risk, and terms of service.

The framework also mandates the establishment of dispute resolution measures between consumers and service providers, allowing consumers to seek redress via independent arbitration or formal complaint processes.

In addition to the above, MiCA ensures service providers establish anti-fraud measures, such as multi-signature wallets and insurance coverage, to detect and prevent fraudulent activities. These mandated measures aim to prevent phishing scams and fake crypto-asset offerings that defraud consumers and result in significant financial losses.

Ensuring Market Integrity and Stability

MiCA addresses the risks of market instability and abuse by establishing rules that promote fair competition and reliable market practices. For example, it establishes anti-monopoly provisions that ensure no single entity can unfairly control or dominate a crypto-asset market.

To prevent market abuse, MiCA prohibits manipulative practices like price manipulation, insider trading, and disseminating false information that could mislead consumers. The regulation requires service providers to implement surveillance and reporting measures to enforce these prohibitions and protect consumers.

By establishing these protective measures, MiCA regulates the issuance and circulation of crypto-assets, such as stablecoins, and reduces the risk of systemic disruptions.

How MiCA & DORA Regulation Impacts the Crypto Industry

The Digital Operational Resilience Act (DORA) is the EU’s framework for ensuring financial entities, including CASPs, can endure operational risks like outages and cyberattacks.

DORA mandates incident reporting, risk management systems, and the maintenance of strong cybersecurity measures. It establishes a unified regulatory framework for digital operational resilience in the financial sector that supports the creation of trust in the crypto industry — a space plagued by fraud and exploits totaling almost $10 billion.

The Role of DORA in Digital Operational Resilience

DORA’s unified framework encompasses traditional institutions and CASPs, ensuring they can prevent, respond to, and recover from Information and Communication Technology (ICT) related disruptions. Its role within the crypto sector is broad, aiming to fill gaps in existing regulations, improve market stability, restore consumer trust, and harmonize financial system resilience.

Synergies Between MiCA and DORA

MiCA and DORA provide a well-rounded regulatory framework that creates a regulated crypto industry. MiCA focuses more on market integrity, transparency and consumer protection, while DORA addresses operational risks and cybersecurity.

- Operational Risks: Where MiCA governs the issuance of crypto-assets and licensing of CASPs to ensure service providers meet operational standards, DORA ensures the operations supporting the activities involved meet resilience standards against cyber threats.

- Security: With MiCA’s clarity on CASP operations, DORA mandates that CASPS adopt risk management frameworks, conduct regular resilience tests, and establish third-party oversight to prevent vulnerabilities in their ICT systems.

- Compliance: MiCA and DORA work harmoniously regarding compliance, maintaining CASP adherence to ensure financial stability and operational safety for consumers — without hindering sustainable growth.

Why Compliance Matters for Web3 Projects

Compliance with both MiCA and DORA may at first seem limiting, but it supports Web3 projects by establishing their credibility and consumer trust in the process. Elements like security, transparency, operational efficiency and integrity are held in high regard by Institutional investors and are ensured through these complementary regulatory frameworks.

Why MiCA Regulation Is a Game-Changer for Crypto

MiCA is a significant step for the crypto industry by bringing clarity to an ecosystem that lacks clear boundaries, rules, and jurisdictional disparity. It addresses regulatory gaps in existing legislation, builds toward a safer and more transparent market, and mandates consumer protections — all while encouraging innovation and growth in crypto.

By introducing mandatory whitepaper measures for token issuances, licensing for CASPs, and clear rules for stablecoins, MiCA creates a unified framework that applies to all EU member states while helping build trust through clarity in the crypto industry.