Blockchains have emerged as independent ecosystems of global financial activity. Ensuring the blockchains' availability, validity, and security are the consensus mechanisms that extend to the transactional foundations within the blocks of the blockchain. For PoS, which has become the most popular consensus mechanism, the amount of staked capital is the determining factor that proportionally increases the amount of security. However, crypto-economic security doesn’t need to be limited to the transactional foundation; it can secure the application layer containing decentralized services and solutions as well (through restaking), drastically improving the entire space and raising the security bar to higher levels.

Realizing this vision is the Eigenlayer protocol. This post will explore Eigenlayer and why Restaking is such a big deal.

What Is EigenLayer?

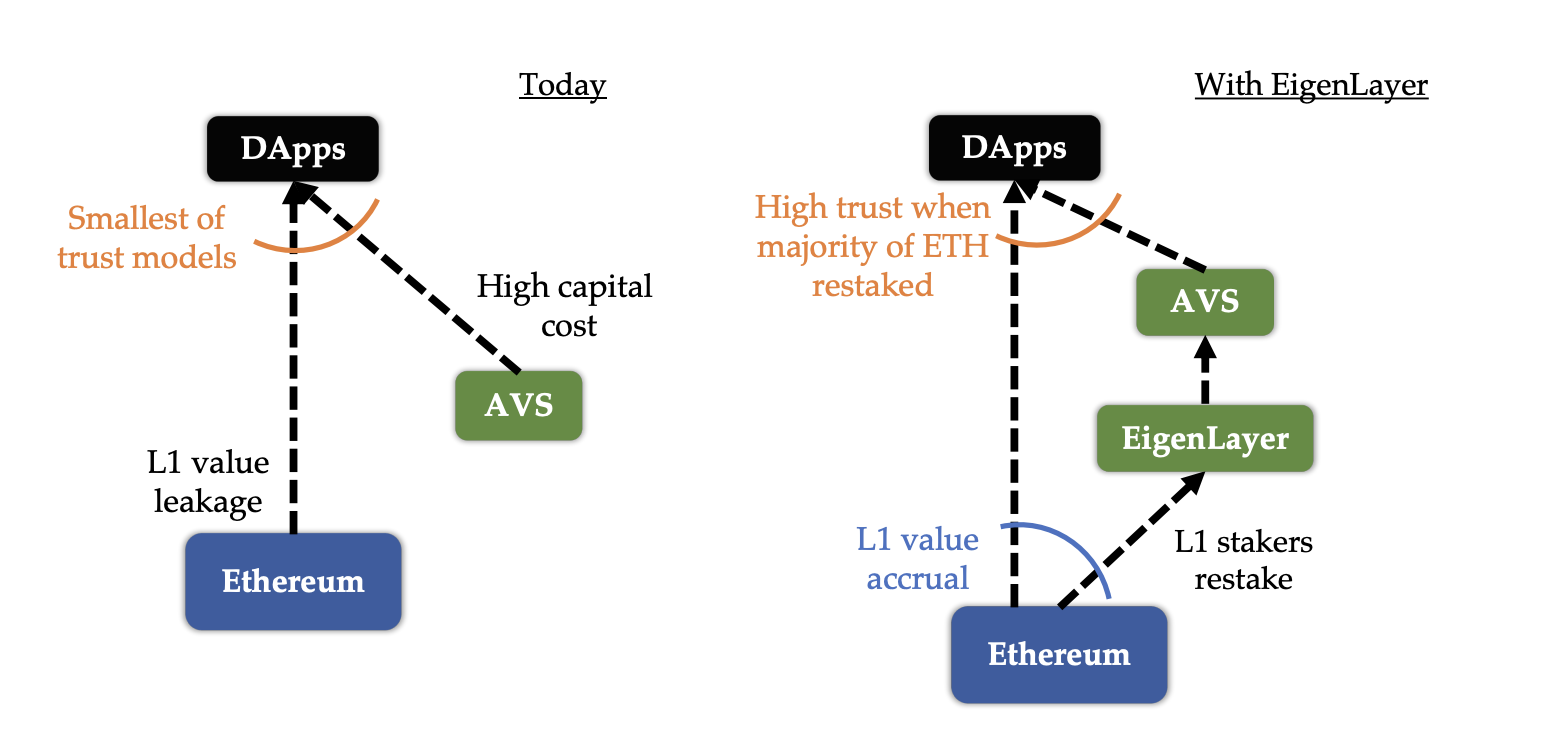

EigenLayer introduced the concept of restaking, a mechanism that allows Ethereum validators to make their staked ETH more useful by committing to secure protocols or services other than the Ethereum network itself. This is done by extending Ethereum’s robust security model, allowing the other protocols (dApps, services) to benefit from billions of dollars worth of staked ETH.

Restaking

In general, the purpose of EigenLayer and restaking is to reuse locked liquidity (and earn twice from the same fund). In traditional staking, an asset can only secure one network. EigenLayer changes this by allowing Ethereum stakes to secure multiple protocols. In Eigenlayer’s words, “Restaking enables staked ETH to be used as cryptoeconomic security for protocols other than Ethereum, in exchange for protocol fees and rewards.” This means validators can earn rewards from various sources without extra capital lockup, making the process more capital efficient and lowering entry barriers for new protocols, thus speeding up ecosystem development.

How EigenLayer Pools Security and Enhances Governance

EigenLayer, at its foundation, facilitates Ethereum validators to stake their ETH again to secure other protocols called Active Validated Services (AVS). The restaking mechanism pools the security together, increasing the costs of potential attacks and building a stronger ecosystem. Validators can participate in supporting various AVSs, aligning economic motivations with security provisions, and promoting competitiveness among different protocols.

Security Pooling and Validator Marketplace:

Validators can opt-in to support various AVSs built on EigenLayer, creating a competitive marketplace. This approach significantly increases the cost of corruption for potential attackers as it shifts from the security of individual protocols to the sum of all staked assets. One side is stakers seeking protocol-generated yield, providing capital to secure systems. On the other hand are protocols and services that need security from the staked capital.

Governance and Security Mechanisms

Various governance and security mechanisms are crucial in this system. They ensure that malicious parties (validators) are slashed (punished), effectively disincentivizing attacks. Slashing is an example of an integral component of EigenLayer’s security model, which helps to regulate validators’ behavior and preserve the integrity of the network.

Within EigenLayer’s system, validators who choose to restake their ETH are under slashing conditions for the Ethereum base layer and the additional AVSs they wish to support. If a validator has been found guilty of malicious action regarding an AVS, some portion of such a restaked ETH can be slashed.

To prevent unwarranted slashing, especially on newer or less-established AVSs, a veto committee within EigenLayer investigates and may overturn any slashing incidents. This multi-tiered method makes it harder for bad actors while protecting ethical validators by ensuring safety nets that enhance overall security and trustworthiness on EigenLayer's network.

EigenLayer Advantages

There are several advantages of Eigenlayer for the Ethereum ecosystem:

- Security and Efficiency: EigenLayer enhances overall network security while improving capital efficiency by allowing validators to secure multiple protocols with the same staked ETH. This pooled approach raises attack costs and enables validators to earn multiple revenue streams from a single stake.

- Diverse ETH Staking: Validators can participate in various protocols beyond Ethereum’s base layer, matching their involvement based on expertise and risk tolerance. This allows for a more dynamic staking ecosystem and optimal resource utilization.

- Advancing Ethereum’s Scaling Solutions: EigenLayer supports the scaling of Layer 2 solutions by providing a secure foundation. Consequently, this accelerates the development and adoption of scaling technologies, thus potentially increasing the throughput of Ethereum and reducing transaction costs.

- Promoting Innovation: EigenLayer has removed some entry hurdles for new blockchain services, therefore spurring the creation of new applications. This competitive climate encourages improvements on earlier ideas, which may expand Ethereum’s horizons, spawning new uses in decentralized platforms.

What Is Liquid Restaking?

Liquid restaking is a new concept that combines the advantages of liquid staking and restaking. It allows EigenLayer users to receive a liquid token representation of their assets restaked through EigenLayer that represents both their original staked ETH and additional commitments made for various protocols supported by EigenLayer. This approach offers flexibility to users who want to trade or use their restaked position in DeFi applications without unstaking and continue earning rewards from Ethereum’s staking and other supported protocols.

The importance of liquid restaking within EigenLayer cannot be overemphasized. It makes participation in the ecosystem more capital-efficient while maintaining liquidity, potentially leading to greater adoption and increased security for the underlying protocols.

ETH Restaking on EigenLayer

At its core, ETH restaking on EigenLayer is a straightforward process.

- Validators on Ethereum decide to join the EigenLayer ecosystem.

- They direct their beacon chain withdrawal credentials toward EigenLayer's smart contracts.

- Ethereum validators choose which Active Validator Services (AVSs) they want to support.

- They must set up and run any other software necessary for these services.

Validators can now earn returns from different sources without increasing their initial stake. It's like making an investment and turning it into a mixture of blockchain services from one company alone. Behind the scenes, sophisticated smart contracts govern this process. These smart contracts are responsible for everything from withdrawal credentials to applying the unique slashing conditions of all the supported services. This represents a delicate interplay between code and crypto-economics that guarantees the system's integrity.

Risks and Challenges in EigenLayer’s Restaking Solution

EigenLayer’s restaking solution is a novel approach to improve crypto-economic security and trust, but it may expose the project to risks and challenges that require careful evaluation. These possible problems range widely from technical vulnerabilities to broader economic and systemic concerns within Ethereum.

Slashing Risk

The major concern here is the level of slashing risk. Though useful in increasing attack costs, EigenLayer’s consolidated security model introduces more intricate slashing conditions. A validator can lose his/her rewards for Ethereum consensus and 100% of their staked ETH if they breach any rules of any supported AVS. This increased penalty acts as an effective deterrent against malicious actors. Still, it also means that honest validators have much to lose, even if they encounter technical issues or make unintentional mistakes.

Centralization Risk

Another important challenge that could come before EigenLayer is centralization risk. With promises of higher yields, more ETH stakers may be attracted toward EigenLayer, making it possible for them to concentrate their power on its ecosystem. Such a concentration would mean that one successful penetration or exploitation by attackers could lead to failure in significant parts of Ethereum’s stake, posing systemic hazards to the wider network.

The competitive nature of the validator services marketplace might result in ‘race-to-the-bottom’ yields among protocols seeking to lure many stakers. Even though it should initially benefit stakers, this may lead to unsustainable economics on supported protocols, compromising their long-term viability and/or reducing end-user returns.

Other Risks

The complex interplay between EigenLayer and the existing AVS ecosystem presents additional difficulties. Bootstrapping new trust networks, value leakage through multiple fee layers, and the possibility of weakened security due to fragmented trust networks are some of the major obstacles to EigenLayer’s uptake and effectiveness.

EigenLayer’s risk factors must be addressed as it continues to grow to guarantee its eventual sustainable integration into Ethereum. Achieving a balance between restaking innovation potential and strong risk management together with viable economic models will be critical for realizing the ultimate benefits of applying this pioneering approach to blockchain security and scalability globally.

Eigen Token and Intersubjective Forks

The EigenLayer project introduced the EIGEN token as a major innovation to address some of the “intersubjective” faults or forks – problems that cannot be identified on-chain but would be agreed by reasonable observers to merit penalties.

For example, imagine an oracle service on EigenLayer that reports a price feed that many users disagree with. Since the "correct" price cannot be objectively determined on-chain, it is an intersubjective fault. EIGEN token holders could then initiate a fork based on staking on the price feed they believe is accurate. The side with the majority EIGEN staked would become canonical, with the losing side's tokens slashed.

The important part is that EIGEN is the staked token that enables the "intersubjective forking" system that resolves the problem without forking the main Ethereum blockchain. So, staking EIGEN secures digital tasks and services with intersubjectively attributable faults. In addition, any AVS on EigenLayer with intersubjectively attributable faults can now obtain cryptoeconomic safety guarantees from EIGEN staking itself. To this end, the EIGEN token has been created as the “Universal Intersubjective Work Token”.

At present, intersubjective staking with EIGEN is in a “meta setup phase,” during which researchers, experts, and other community sections have been discussing what parameters should be implemented to make it more efficient.

Summary

EigenLayer is a recent development aimed at enhancing the crypto-economic security of the Ethereum ecosystem. It introduces a mechanism that allows for the restaking of ETH, thereby improving capital efficiency. Furthermore, EigenLayer is working on establishing a decentralized trust system via its marketplace. This initiative is also designed to lower entry barriers for new protocols, potentially contributing to the strengthening of the Ethereum ecosystem.

Eigenlayer is not without risks or challenges; it is a new and innovative technology. Still, if implemented and embraced successfully, it may become instrumental in defining what lies ahead for Ethereum specifically and the general Web3 space itself.