TL;DR:

- Decentralized Physical Infrastructure Networks (DePINs) use crypto incentives to efficiently coordinate the buildout & operation of physical and digital infrastructure.

- DePINs incentivize individuals and organizations to contribute digital or physical resources to a decentralized network, earning crypto in return.

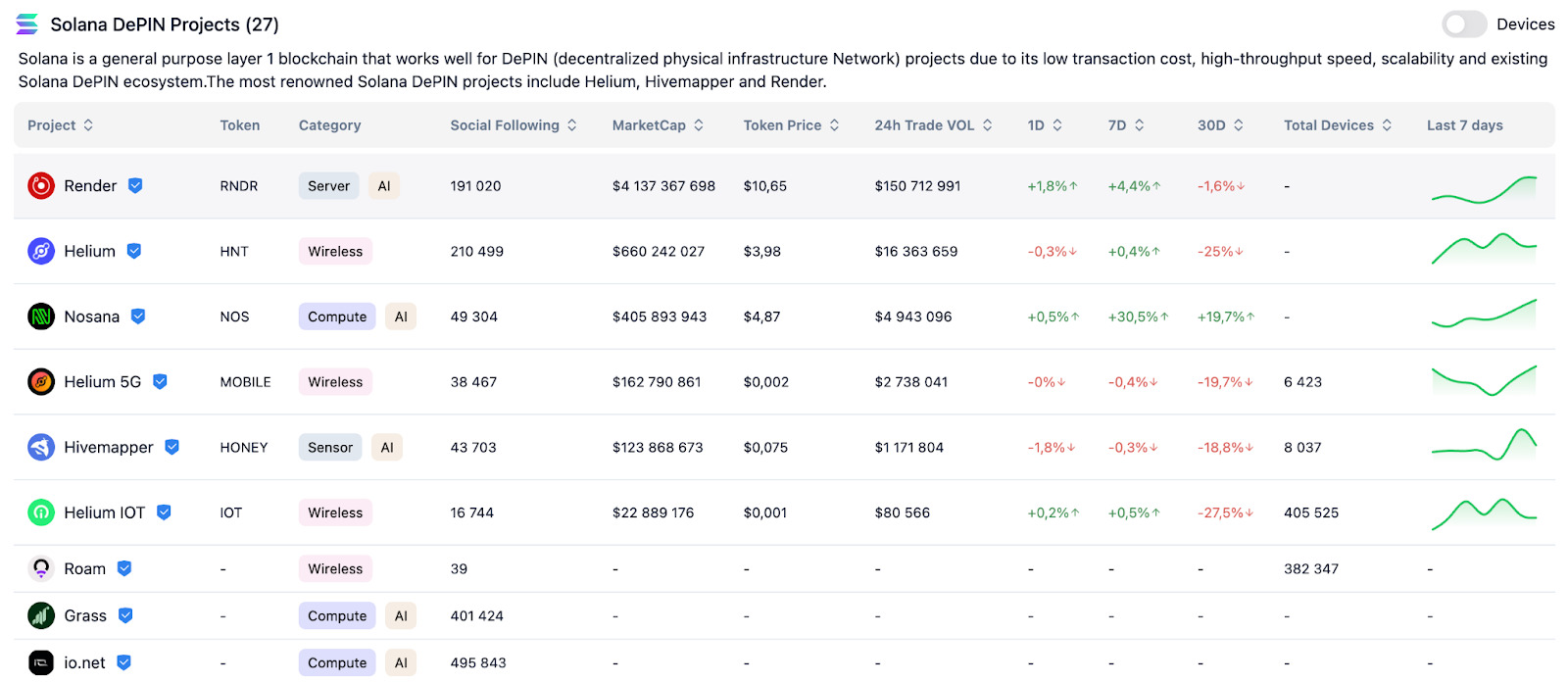

- Solana has emerged as a prominent player in the DePIN ecosystem.

- Popular DePIN projects include Filecoin (storage), Helium (wireless connectivity), Render Network (GPU rendering), and Hivemapper (geospatial data).

- With proper security measures (physical security, network security, data integrity, and smart contract security), DePINs can democratize access to infrastructure.

The blockchain revolution has always aimed at democratizing industries, and Decentralized Physical Infrastructure Networks (DePINs) are now transforming how we build and manage physical infrastructure.

DePINs connect real-world physical networks to digital ones powered by blockchain, offering a decentralized, cost-efficient, and scalable approach to infrastructure development and management. The new sector has garnered much attention in the past months, with over $20 billion in market cap.

In this article, we'll explore DePIN's principles, operational workflows, advantages, and the pioneering projects driving this innovative concept forward.

What Is DePIN?

Decentralized Physical Infrastructure Networks (DePINs) connect the physical world to blockchain technology by incentivizing contributions of digital or physical resources, like computing power or storage, to a decentralized network. Contributors earn cryptocurrency tokens based on their contributions.

DePINs create P2P shared resource networks, allowing on-demand access without central providers. Leveraging blockchain, they ensure transparency, security, and efficient infrastructure development. The excitement for DePIN in the crypto world lies in its potential to create revenue driven by the utility of the network and resources rather than speculation.

How DePIN Works

DePIN systems combine blockchain architecture, physical infrastructure networks, token rewards, and off-chain networks. Here's how they work together:

- Blockchain Architecture: Executes smart contracts, manages transactions, and distributes rewards.

- Physical/Digital Infrastructure: Resources like energy grids and computing power contributed by individuals or organizations.

- Token Rewards: Contributors earn cryptocurrency tokens based on their resources' value, creating an infrastructure economy.

- Off-Chain Network: Handles the actual transfer of resources, while blockchain manages transactions and rewards.

Real-World DePIN Example

For example, in a decentralized cloud storage network like Filecoin, individuals contribute their unused storage space to the network. Users who need storage can rent this space from the network by paying with the native FIL tokens. The blockchain handles the incentive distribution to storage providers, while data transfer occurs off-chain.

What Role does Solana Play in the Emerging DePIN Sector?

Solana has emerged as a prominent player in the DePIN ecosystem. Its fast transaction processing capabilities, low fees, and scalability make it an attractive choice for DePIN projects that require efficient handling of large volumes of data and transactions.

Several DePIN projects, such as Render, Helium, Ionet, and GetGrass, have chosen to build their solutions on Solana. The platform's developer-friendly ecosystem and strong community support further contribute to its appeal within the DePIN space.

As of writing, the Solana ecosystem boasts 27 DePIN projects, according to dePINscan.

DePIN Web3 Projects

The DePIN concept has given rise to numerous innovative decentralized projects across various IT markets, including Wireless, Compute, Wireless Energy, AI, Services, Sensors:

- Filecoin (FIL): Filecoin is a decentralized storage network that incentivizes users to contribute their unused storage space. By leveraging this shared storage capacity, Filecoin provides an efficient alternative to centralized cloud storage solutions.

- Helium (HNT): Helium is a decentralized wireless network that aims to provide global internet connectivity by leveraging a network of node operators. Users can earn HNT tokens by hosting Helium hotspots, which are wireless network nodes.

- Render Network: Render Network is a decentralized GPU rendering platform that allows individuals and organizations to contribute their idle GPU resources. This shared computing power is then used for rendering tasks, such as 3D animation and visual effects, with contributors earning RNDR tokens as rewards.

- Hivemapper (HONEY): Hivemapper is a DePIN project that maps the physical world through crowdsourced data. Contributors can earn HONEY tokens by providing geospatial data, such as street-level imagery and environmental sensor readings, used to create detailed maps and analytics.

- Akash Network (AKT): Akash Network is a decentralized cloud computing marketplace that uses underutilized data center capacity. It offers a cost-effective and flexible alternative to traditional cloud providers.

PRNs and DRNs

DePIN projects can be classified into Physical Resource Networks (PRNs) and Digital Resource Networks (DRNs):

- PRNs focus on location-dependent, tangible infrastructure and hardware resources (e.g., wireless connectivity or geospatial data).

- DRNs deal with location-independent digital resources like computing power and storage space, accessible from anywhere with an internet connection (e.g., storage or GPU rendering).

| Physical resource network | Digital resource network | |

| Resources | Tangible, location-dependent | location-independent, digital |

| Areas | 1. Wireless (5G, IOT, WiFI) 2. Geospatial (positioning, mapping, imagery) 3. Mobility (data networks, rideshare, delivery) 4. Energy | 1. Storage 2. Databases 3. Compute (general-purpose, AI, machine learning) 4. Bandwith (CDN, VPN) |

| Examples | 1. HiveMapper — a decentralized global map. 2. Dimo — universal digital identity for cars. | 1. Filecoin — a decentralized storage provider. 2. NodesAI — GPU rental and lending platform. |

It is important to note that both PRNs and DRNs must be decentralized to be considered DePINs. For example, Uber is a physical resource network in the rideshare market, and AWS is a digital resource network in the storage market, but they are not DePINs because they are centralized.

Security Considerations in DePIN

While DePIN networks offer numerous advantages, ensuring security is paramount to their successful implementation and adoption. As the DePIN system requires a lot of moving parts to synchronize, there are several key security considerations, including:

- Physical Security: The physical infrastructure contributed to DePIN networks must be secured against unauthorized access, tampering, or sabotage, as any compromise could potentially disrupt the entire network.

- Network Security: DePIN networks rely on secure communication protocols and robust encryption mechanisms to safeguard data transmission and prevent unauthorized access or manipulation.

- Data Integrity and Privacy: DePIN networks handle sensitive data, such as user information and resource utilization details. Ensuring data integrity and privacy through appropriate access controls and secure data handling practices is crucial.

- Smart Contract Security: DePIN projects heavily rely on smart contracts to manage incentives.

DePINs merge financial incentives and economic structures with physical and digital resource networks. This adds exploitable resources and vulnerable access points that aren’t present in other network infrastructures we have seen in different sectors.

To ensure the utmost security, developers should implement robust encryption protocols, leverage the power of blockchain technology to maintain tamper-proof records of transactions and data and ensure regular audits of smart contracts, governance, and incentive mechanisms.

The DePIN Flywheel

If designed correctly, the DePIN incentive mechanism can create a powerful flywheel effect that drives the growth and success of the DePIN network. Here's how the flywheel works:

- Enable Incentives: As the project gains popularity, it will offer incentives to attract users.

- Increased Usage: More users leveraging the DePIN network increases the demand for its services.

- Token Price Rise: Higher demand for services increases the value of the native cryptocurrency token.

- Contributor Incentive: The rising token value incentivizes more individuals and organizations to contribute resources, earning valuable tokens.

- Network Expansion: With more contributors, the DePIN network expands its capacity to handle a larger user base.

- Investor Interest: The network's growth and token value appreciation attract investors, bringing additional funding for further development.

This self-reinforcing cycle plays a crucial role in the long-term sustainability and growth of DePIN projects, benefiting all participants.

Future of DePIN: What’s In Store?

DePINs democratize access to infrastructure, making it more resilient, transparent, and efficient. Combined with decentralized governance and incentives, DePINs can become huge economic networks with lots of user participation. In addition to the network effects that the DePIN flywheel has the potential to bring, DePIN is poised to self-sustain and proliferate.

DePIN projects can offer numerous advantages over traditional centralized systems, including:

- Decentralization: Eliminates single points of failure and reduces censorship risks.

- Cost-efficiency and Scalability: Utilizes shared global resources, reducing costs and enabling rapid scalability.

- Security and Efficiency: Ensures data integrity and enhances security.

- Accessibility: Operates permissionless, allowing broad participation.

- Incentivization: Encourages participation and resource contribution, creating a self-sustaining ecosystem.

While the popularity of the DePIN sector will undoubtedly continue, security must be the utmost priority, ensuring that all network participants can participate safely.

As mentioned in our Q1 2024 security report, $824,405,224 was stolen in the Web3 sector that quarter. While the DePIN sector is intriguing, it won’t be immune to hacks.

Stay tuned as Hacken covers emerging Web3 trends and security!