Blockchains exist as separate distributed networks with different tokens. As a result, the native asset of each chain is technically not transferable to another. For instance, users cannot move their assets from Avalanche to Solana because they are two different ecosystems.

But blockchain bridges fix this missing link; they ensure cross-chain interoperability. They break down the dividing wall among different blockchain networks so they can interact efficiently. A bridge can take an asset on blockchain A and give the equivalent of the same asset on blockchain B.

Did you know that besides the transfer of assets bridges also facilitate the exchange of data between different blockchains? Read on to discover the inner workings of cross-chain bridges and everything you need to know to transfer cryptocurrency across blockchains safely.

How Do Blockchain Bridges Work?

Blockchain bridges are platforms that facilitate the transfer of assets and data from one blockchain ecosystem to another. They can be decentralized, centralized, or even hybrid. There are two ways bridges carry out asset transfer: wrapped assets or liquidity pool.

Wrapped Asset Method

The owner of a native asset of Blockchain A can receive the equivalent of the same asset in Blockchain B. To put it in perspective, a user can pass through a cross-chain bridge SOL on Solana to get an equivalent of Wrapped ETH on Ethereum.

A smart contract locks up the deposited SOL during the transfer to take it out of circulation. Then it releases a Wrapped ETH in return.

But a slightly different mechanism happens when you bridge tokens back to the original blockchain—for example, exchanging WETH on Cardano for ETH on Ethereum. The WETH will be burned in exchange for the ETH.

Liquidity Pool Method

Some blockchain bridges, such as “Cross-Chain Bridge” and Synapse Protocol, adopt different approaches. They have liquidity pools for a wide array of assets. For instance, there are liquidity pools for WETH on BNB Chain, Polygon, and so on.

These liquidity pools serve as banks. For instance, when a user wants to bridge WETH from Polygon to ETH on Ethereum, Cross Chain Bridge allocates funds from their liquidity pool to send the user ETH in Ethereum.

How do bridges get assets into their liquidity pools?

Most bridges using this method often have staking and farming programs where users can lock their assets into the pool for periodic rewards. The bridge uses its locked assets to settle bridging requests.

Types Of Crypto Bridges

They exist in different forms based on the developers behind them and the degree of control they give to users.

Trusted Bridges

A trusted bridge is a cross-chain protocol controlled by a centralized entity. During bridging, the asset control moves from the users to the centralized authority. Users have to "trust" the integrity and efficiency of the centralized entity to perform the transaction.

They must assume that the centralized entity will never steal their assets and protect their funds from attackers. Binance Bridge is a prominent example of trusted bridges.

Trusted bridges are more suitable for those prioritizing speed and lower gas fees over cross-chain security.

Trustless Bridges

Unlike trusted bridges, trustless bridges do not rely on any single central authority. Instead, they rely on algorithms and smart contracts for facilitation.

Users are also responsible for their funds because there is no centralized system to do that for them.

Trustless bridges are by far more decentralized than trusted bridges. While trustless bridges might not be as cheap as their counterparts, they are more secure if the underlying technology has proven its worth. Trustless bridges are the essence of decentralized finance (DeFi).

Bridge Use Cases

Bridges are quite useful in the crypto industry. Here are the most important use cases.

Transfer Crypto To A Different Blockchain

Bridges come in handy whenever you want to transfer your crypto from one blockchain to another. If you bridge SOL, you will get SOL, just in a different form and on a different blockchain.

A cross-chain bridge usually just takes some asset on blockchain A and gives the equivalent of the same asset on blockchain B. For example, if the user wants to bridge ETH from Ethereum to Binance Smart Chain, they will deposit ETH on Ethereum and get some token pegged to the ETH value on BSC

Alexander Nazarov, Lead dApp Auditor at Hacken

Exploring Various Ecosystem dApps

Every blockchain ecosystem has its unique dApps. You can bridge your asset from chain A to chain B to explore some dApps in chain B.

Cheaper Conversion

Most of the time, the conversion of assets on bridges requires lower transaction fees than other platforms. Hence, the reason some users often prefer to use bridges.

Risks Of Crypto Bridging

Every innovation bears its inherent risk, and crypto bridges are no exception. As efficient as they are, cross-chain bridges come with risks.

Centralized Theft

Centralized crypto theft is inherent only to trusted bridges. The centralized authority controlling the bridge can unanimously steal users' funds. Even though no founding team of any trusted bridge has rugged the users, it is possible.

Cloned Bridge Websites

DeFi is booming, and scammers now come up with cloned websites to defraud unsuspecting users. The fake cloned website looks like the actual bridge allowing scammers to steal crypto when a user deposits it for bridging.

On this note, always double-check against phishing to ensure you transfer funds to a genuine bridge application.

Smart Contract & Cybersecurity Attacks

Blockchain bridges have been the target of the most massive attacks in the blockchain world. Hackers have always focused on them due to their relatively high volume of funds. Research confirms that over $2.5 billion have been stolen from cross-chain bridges. This is a quick stat of how much hackers have stolen from some bridges:

- Ronin Bridge — $522 million

- Wormhole Hack — $320 million

- Nomad Hack — $200 million

- Multichain Bridge Hack — $3 million

Why Use Bridges Instead Of Exchanges?

There are different routes to transferring assets from one chain to another. While bridges are a prominent option, crypto exchanges also offer cross-chain functionality.

For instance, assume a user has BTC and they need ETH. They can swap their BTC to ETH on a centralized exchange like Binance. Then they can keep the ETH in their Binance wallet or send it to another Ethereum-compatible wallet.

There are four major reasons some prefer bridges to exchanges.

Cost. The process of swapping on an exchange, then sending to another wallet can incur some significant amount of fees. On the other hand, the fees could have been incurred once and for all in a single bridge. Even at that, the transaction fees of most bridges are ridiculously low compared to what exchanges would have charged.

Speed. The processes involved in going through exchanges can be quite time-consuming compared to using a bridge.

Eligibility for airdrops. Blockchain ecosystems often encourage decentralized on-chain interactions rewarding their users with frequent airdrops. On the contrary, those who transfer assets with centralized exchanges cannot benefit from this.

Decentralization. Finally, some choose bridges mainly because of personal preferences and how it is more native compared to exchanges.

3 Most Popular Blockchain Bridges

Portal

Portal is a cross-chain protocol built on Wormhole. With a TVL of over $288 million, Portal is one of the top bridges in Web3, according to DeFi Lama. It houses 18 popular chains, including NEAR, Celo, and Ethereum.

Portal Pros

- Supports 18 blockchains

- Supports NFTs

- Users can redeem tokens in case of technical mishaps

- Best for bridging from Solana to Ethereum

Portal Cons

- Only support NFTs based on ERC-721 and supply of 1

- Fees can be relatively high

Across Protocol

Across is an interoperability solution powered by intents. Intents is proving to be a winning solution in the bridging space as Across tends to dominate the routes its supports, as it is frequently able to provide the cheapest and fastest bridge option.

Unlike many other bridges, Across only transfers canonical or genuine assets for the safety of its users, instead of representative synthetic tokens. For this reason, Across is only deployed on chains that have an official bridge that helps carry out its canonical token transfers under the hood.

Across Pros

- Generally the cheapest and fastest bridge for its supported routes

- Highly secure canonical token maximalism

- No slippage model

Across Cons

- Only can bridge to chains with a canonical bridge

- Token support is mainly only stables

- If utilization is extremely high, slow fills can be 2-3 hours

Poly Bridge

Poly Network is one of the most popular cross-chain bridges with over $335 million TVL and supports 32 prominent blockchains.

Poly Pros

- Bridging happen within seconds

- Easy to navigate

- Supports NFTs

Poly Cons

- Bridges limited token pairs

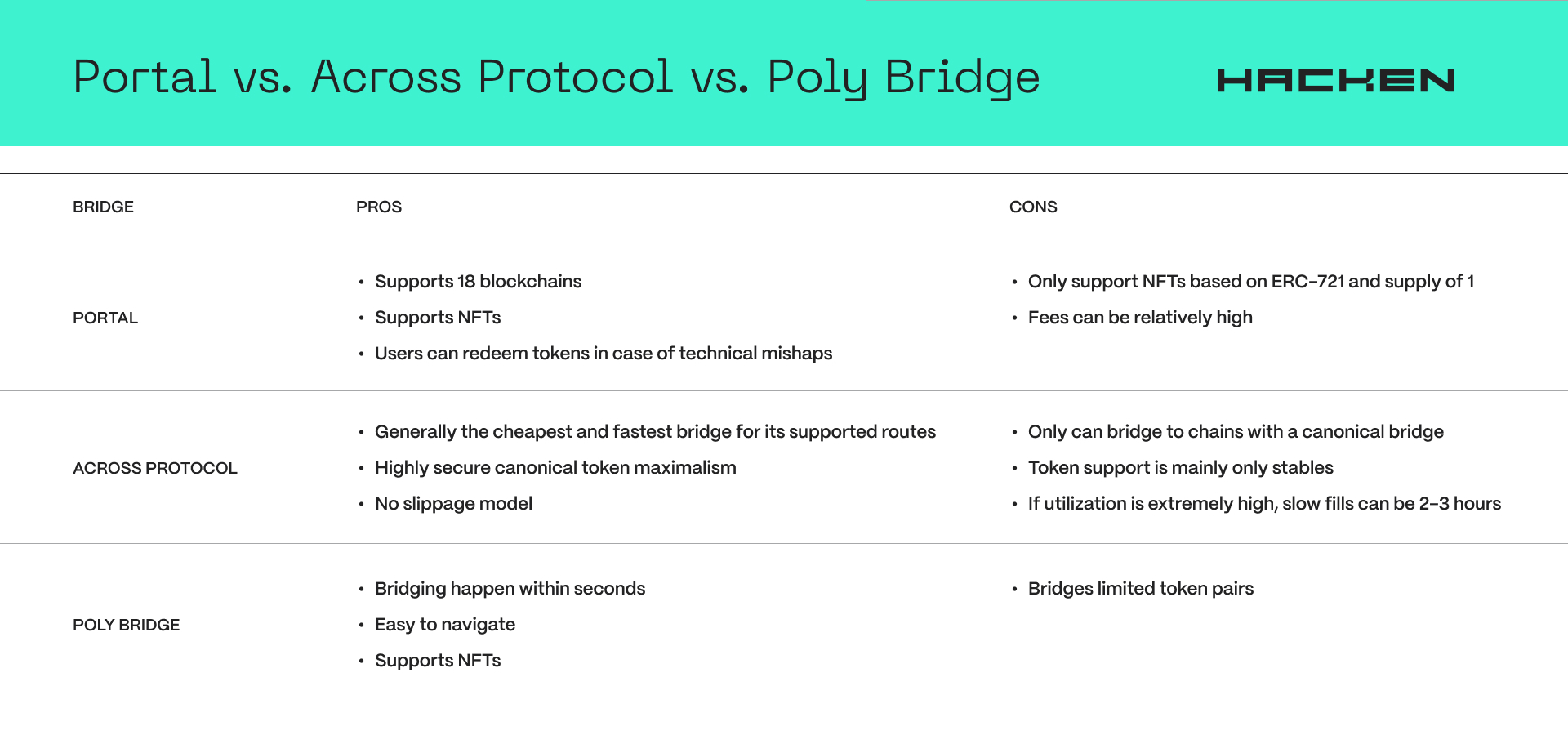

Portal vs. Across Protocol vs. Poly Bridge

| Bridge | Pros | Cons |

| Portal | Supports 18 blockchains Supports NFTs Users can redeem tokens in case of technical mishaps | Only support NFTs based on ERC-721 and supply of 1 Fees can be relatively high |

| Across Protocol | Generally the cheapest and fastest bridge for its supported routes Highly secure canonical token maximalism No slippage model | Only can bridge to chains with a canonical bridge Token support is mainly only stables If utilization is extremely high, slow fills can be 2-3 hours |

| Poly Bridge | Bridging happen within seconds Easy to navigate Supports NFTs | Bridges limited token pairs |

Concluding Remarks

Bridges are touchpoints for everyone in Web3 to transfer assets from one blockchain to another regardless of architecture or consensus mechanisms. A significant amount of DeFi trade volume passes through bridges.

Seeing how innovative bridges are to the Web3 space, it is important to know simultaneously that they are the target of hackers. Bridge hacks take up to 50% of all the losses in crypto. Therefore, bridge developers should audit the important parts of their software.

First, a smart contract audit is important to ensure there are no weaknesses in the computer code that automates every state transition. Secondly, ensure your dApp security for safe interactions of off-chain components with blockchain networks.