Bybit, a leading cryptocurrency exchange, has been conducting monthly Proof of Reserves (PoR) audits with Hacken since June 2024. This transparency initiative proved critical during the recent $1.5B hack, helping stabilize withdrawals and reinforce user confidence.

Bybit’s latest PoR audit, verified by Hacken on February 26, 2025, confirmed that Bybit maintains a reserve ratio exceeding 100%, demonstrating its solvency and resilience.

Crisis Management & The Role of PoR

Cointelegraph praised Ben Zhou for his decisive leadership during the largest crypto exploit to date, highlighting his transparency and real-time crisis communication. However, Bybit’s response was not just about swift actions—it was built on months of preparation.

The PoR audits with Hacken weren’t a last-minute reaction but a long-term commitment to transparency and financial resilience. This foresight acted as a critical backstop, preventing panic-driven withdrawals and reinforcing trust when it mattered most.

Why Proof of Reserves Matters

Many exchanges have collapsed due to financial mismanagement, as seen with FTX. PoR audits ensure an exchange holds enough assets to cover liabilities, providing verifiable proof of solvency.

Hacken’s Role in PoR Audits

Bybit has gone beyond simply implementing PoR; it has engaged an independent auditor, Hacken, to verify reserves. Hacken’s audits provide third-party confirmation that Bybit’s assets exceed user liabilities, ensuring solvency and accountability.

Since June 2024, Hacken has applied a rigorous methodology to verify Bybit’s financial health, including:

- Proof of Liabilities – Checking user balances to confirm accurate liability reporting.

- Proof of Ownership – Verifying Bybit controls its wallets using cryptographic methods.

- Reserve Calculation – Ensuring total assets match or exceed liabilities.

- Merkle Tree Validation – Allowing users to independently verify their funds in the audit.

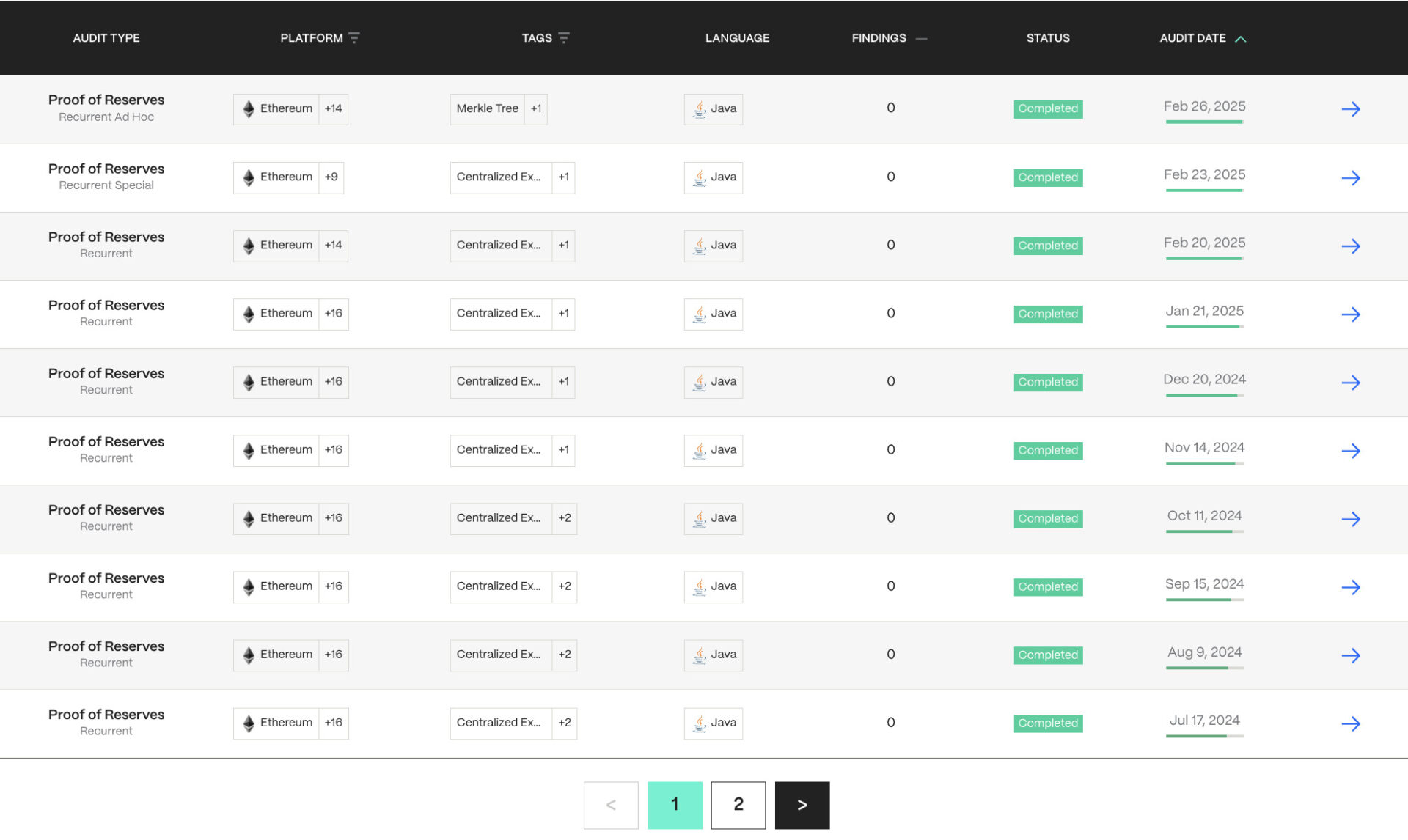

The list of the recurrent PoR audits made by Hacken for Bybit.

Key Findings from the February 2025 PoR Audit

Bybit’s latest PoR audit, conducted on February 26, 2025, confirmed that the exchange maintains a reserve ratio above 100% across all covered assets, despite the recent security breach.

The reserve ratio is a financial metric that indicates whether an exchange has enough assets to fully back user deposits. A ration above 100% shows that a custodian holds more assets than user liabilities, meaning all user funds are fully backed.

🚨 @Bybit_Official Proof of Reserves Update

— Hacken🇺🇦 (@hackenclub) February 21, 2025

Today’s hack was massive—a tough hit for the industry. But here’s the bottom line: Bybit’s reserves still exceed its liabilities.

As their independent PoR auditor, we’ve confirmed that user funds remain fully backed.

🔹 What this…

Key Metrics:

✅ Users Covered: 65M+

✅ Merkle Proof Validation: User balances verified for accuracy (GitHub)

✅ Audited Wallets: Verified across Ethereum, Bitcoin, Binance Smart Chain, and Solana

✅ Collateral Ratios: BTC, ETH, USDT, XRP, and 35+ other assets all above 100% reserves

Hacken’s team thoroughly analyzed Bybit’s total assets and liabilities, ensuring the accuracy of client balances. The audit included:

- Merkle tree code verification to confirm integrity.

- Liabilities report reconciliation to cross-check results.

- Root hash calculations & validation process audits for added security.

Proof of Ownership & Reserve Calculation

To verify ownership of reserves, Bybit provided Hacken with a full list of public keys/addresses holding in-scope assets. Bybit then executed small outgoing transactions from each address, which Hacken monitored and confirmed.

This process proved Bybit’s control over these wallets at the time of the audit.

Although the ETH reserves were impacted, Bybit’s diversified holdings and strong financial position allowed the exchange to fully restore reserves and maintain solvency. Bybit restored reserves within 72 hours, securing 447,000 ETH from Galaxy Digital, FalconX, and Wintermute, ensuring solvency and maintaining withdrawal operations.

Conclusion: Setting a New Standard for Transparency

Bybit’s long-term commitment to PoR audits, well before the security breach, demonstrates that transparency isn’t just a reaction to crises—it’s a core principle. Unlike exchanges that implement PoR after facing issues, Bybit integrated it proactively, strengthening user trust and market stability.Bybit’s partnership with Hacken sets a new benchmark for transparency in crypto. Regular PoR audits ensure solvency, accountability, and resilience in an industry where trust is everything.

Note: Hacken’s PoR audits assess solvency only and do not include security evaluations. Hacken has not provided security services for Bybit but remains available to assist exchanges in enhancing security.